Ardo and Dujardin Foods on March 28 jointly announced the signing of a merger agreement that will result in a frozen vegetable, fruit and herb production and marketing company whose combined sales amounted to more than 811,000 tons worth €810 million in 2013. The group, which will operate under the name Ardo, will further boost Ardo’s position as the leading volume packer of frozen vegetable products in Europe.

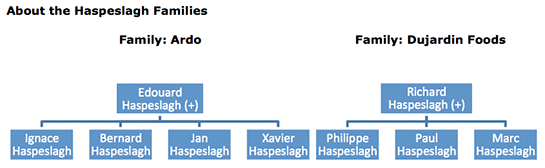

The two frozen food companies, each headquartered in the West Flanders region of Belgium and started independently by two brothers 40 years ago, are preparing to come together as one firm, subject to approval by the relevant competition authorities. As part of the transaction, NPM Capital, a private equity firm that held a minority stake in Dujardin Foods, is selling its stake. In the new group the Haspeslagh families will own 100% of the shares.

Haspeslagh family members gathering to sign a merger agreement between Ardo and Dujardin Foods are (from top to bottom, left to right) cousins Jan, Philippe, Ignace, Paul, Xavier, Marc and Bernard.

Haspeslagh family members gathering to sign a merger agreement between Ardo and Dujardin Foods are (from top to bottom, left to right) cousins Jan, Philippe, Ignace, Paul, Xavier, Marc and Bernard.

The rationale behind the planned merger is to create a robust working platform that will enable the business to operate sustainably in the frozen vegetable, fruit and herb sector for years to come, and to lay the basis for a third-generation, professionally-managed family business.

Both organizations will continue to operate independently, led by Jan Haspeslagh for Ardo, and Rik Jacob for Dujardin Foods, while the integration planning is undertaken. The future board, chaired by Philippe Haspeslagh, will consist of family representatives and two independent directors.

The merger of the two like-minded companies will optimize all available synergies, including complementary areas of business, to maintain market positions and competiveness. Following the initial period, transitional changes will be managed to ensure that goods, services and customer relations are maintained and/or improved. The new structure will be designed to respond to the demands of the market and to strengthen relationships with partners in the retail, foodservice and food industry markets.

Heralding the merger, Jan Haspeslagh, ceo of Ardo, said: “Joining two complementary companies, where the owners are already closely related, is a natural step that prepares us for the future and ensures that the business remains family-owned. With our similar approach to business and common desire to combine entrepreneurship and professionalism, I am confident that we will create a cohesive company. This announcement is excellent news for all stakeholders.”

Rik Jacob, ceo of Dujardin Foods, added: “The new Ardo will be an even greater company with a unique European footprint of large scale, specialized plants, sound agricultural expertise, professional management and an entrepreneurial attitude.”

Philippe Haspeslagh, who will serve as chairman the board, and who is also a leading academic specialized in mergers and acquisitions, commented: “We are committed to creating further professional opportunities for our combined management teams while sustaining the family business for the next generation. At shareholder level this signifies the coming together of seven cousins, with clear roles for the family, the board and the management.”

About Ardo

About Ardo

Ardo began its vegetable business activities in the 1950s, growing and trading vegetables at the family farm near the village of Ardooie. Venturing into freezing in the 1970s, the company has since developed production and sales of frozen vegetables throughout Europe. Today, Ardo operates 15 production, packing and distribution units in eight European countries, and employs around 3,000 people. In 2013 the group grew, froze and sold 611,000 tons of vegetables and fruit worldwide, with a net consolidated turnover of €607 million.

About Dujardin Foods

About Dujardin Foods

Dujardin Foods, based in Ardooie-Koolskamp, has five production sites in Belgium, France and the United Kingdom that specialize in manufacturing frozen vegetables, aromatic herbs, ingredients and ready-to-eat meals. The company, which has around 800 employees, produced approximately 200,000 tons of product worth €213 million last year. Like Ardo, it focuses on the international retail, industrial and foodservice markets.