The importance of frozen strawberries to growers and packers in Morocco continues to increase, according to Herk-de-Stad, Belgium-based Dirafrost. It reported on January 12 that the fresh versus frozen strawberries ratio has seen frozen’s market share rise significantly in the last 10 years.

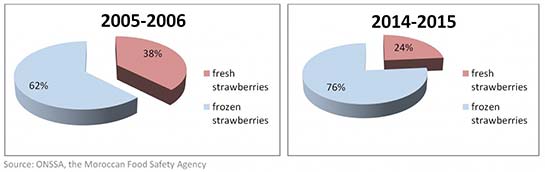

Morocco ranks as one of the leading countries in the world for strawberry production, and the majority of the harvest goes into freezers. When reviewing statistics of the past decade, one sees that the fresh to frozen ratio is tilting toward higher frozen volumes. In the 2005-06 season the ratio was 62% frozen strawberries versus 38% fresh strawberries. Recently this ratio has evolved to 76% frozen versus 24% fresh. Of the total output of 52,000 tons of Moroccan frozen strawberries (see figure 2014-15), Dirafrost accounted for a quarter of the production.

Outlook for 2016

Strawberry production in Morocco has risen dramatically since November. Output is almost double the quantity of fresh strawberries in comparison with the last season, due in large part to higher than normal temperatures in November and December. This early boost in volume will have an impact on the duration of the season and productivity of the plants. History would suggest to veteran industry observers in the Maghreb region that the season may end a bit earlier than usual.

Moroccan and Egyptian Production Coincide

This year the strawberry season in Egypt is starting later than normal, which means the production of frozen strawberries in both Egypt and Morocco are going to coincide. Usually the countries’ production timetables alternate, with the Egyptian season ending in February and the Moroccan season starting in mid-February. The bottom line is that the 2015-16 strawberry season will be shorter in both countries this year, which will likely result in less volume.

Dirafrost, a member of the Austrian Agrana Group, operates production plants in Serbia as well as in Morocco and Belgium. It is a major supplier of frozen red fruit, including raspberries, to European foodservice, retail and industrial markets. The company’s vast sourcing area of 96,580 hectares of company-owned and privately contracted fields typically harvests enough fruit to yield 28,000 tons of finished product per annum.