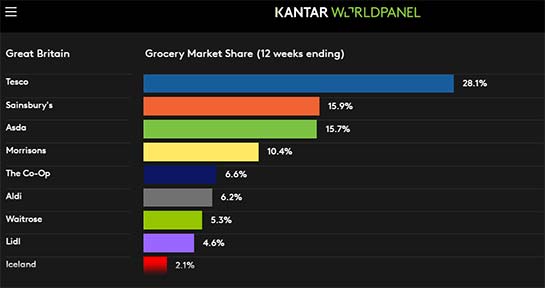

The latest United Kingdom grocery share figures from Kantar Worldpanel, published on September 20 for the 12-week period ending September 11, 2016, show that despite continued deflation of 1.1%, supermarket sales increased by 0.3%. Particular growth in alcohol purchases was evident, fueled in part by celebrations of Britain’s sporting success during the Olympic Games.

On the frozen front, it was no surprise that ice cream sales rose along with the mercury during the hot summer season. The recent run of success by frozen food retail specialist Iceland continued, as it rang up an impressive 6.3% more than during the same period a year ago, with its core ice cream and frozen fish categories performing well. The Deeside, Wales-headquartered chain has a 2.1% of the UK market.

On the frozen front, it was no surprise that ice cream sales rose along with the mercury during the hot summer season. The recent run of success by frozen food retail specialist Iceland continued, as it rang up an impressive 6.3% more than during the same period a year ago, with its core ice cream and frozen fish categories performing well. The Deeside, Wales-headquartered chain has a 2.1% of the UK market.

Deep discount retailers Aldi and Lidl displayed ongoing strength with sales rising 11.6% and 9.5%, respectively, compared with the like three-month period in 2015.

Fraser McKevitt, head of retail and consumer insight at Kantar Worldpanel, commented: “Not only are both continuing to expand their store estates, but existing customers are visiting more frequently and upping their basket size. The discounters are helping drive the industry-wide growth in premium own label lines, with marketing campaigns moving away from showcasing only price to a focus on quality.”

Collectively, the premium private label segment grew by 29.5% among the discounters during the last tracking period.

“Shoppers now spend an average of £19.24 when visiting the discount retailers, and at a time of falling prices this increase of 4% is not to be sniffed at,” said McKevitt. “Lidl reached a market share high of 4.6% this period.”

The Waitrose chain, which has a 5.3% share of the UK market, posted a 3.4% rise in receipts during the 12-weeks, compared with the same timeframe in the previous year.

“Ice cream sales were up almost 43%, barbecue sales were up by 100% and service counter meat sales were up by 32%,” said Waitrose Retail Director Ben Stimson.

Tesco saw sales dip 0.2%, though this was reportedly the best 12-week result it has recorded over the past two years. The chain remains the market leader in the UK by far, however, with a 28.1% share. Its closest rival, Sainsbury’s, currently claims 15.9% of the market, followed by Asda at 15.7%.

Noting that receipts declined by 1.4% at Sainsbury’s, McKevitt remarked: “Overall prices have fallen at Sainsbury’s, as have its levels of promotional activity as it continues to roll out its simpler pricing strategy.”

“Meanwhile,” he continued, “after posting like-for-like growth in last week’s trading update for the first half of 2016, Morrisons’ market share fell by 0.3 percentage points to 10.4%, reflecting its reduced store portfolio. Online sales are becoming more important for the grocer, with shopper numbers up by 45% on last year.”

Convenience retailer Co-op continues to outperform the market with sales growth of 3.1%, primarily through own label lines, reported the Kantar Worldpanel analyst. It share of the UK grocery market is currently 6.6%, just ahead of Aldi’s 6.2%.