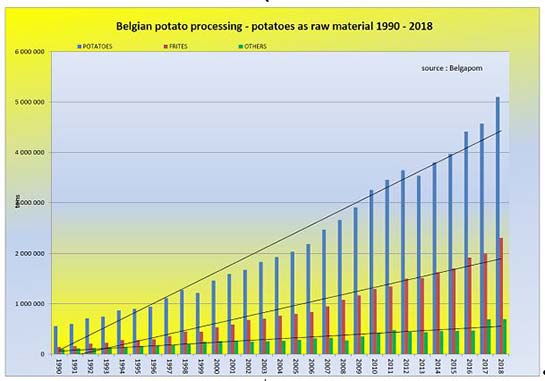

More than five million tons of potatoes were processed in Belgium during 2018, setting an all-time record and registering the sharpest annual increase since the 1990s. The use of potatoes as a raw material rose by 11.6%, which was by far the greatest increase in the history of this growing segment of the Belgian food industry.

Berlare-based Belgapom, the association representing the Belgian potato trade and processing sectors, notes that last year’s tonnage marked a whopping 1,000% increase from the average per annum volume of 500,000 tons processed into frozen fries, mashed potato products, flakes and granules less that three decades ago.

Belgium currently ranks as the largest exporter of frozen potato products on the planet, shipping value-added spuds to over 150 countries from 18 processing plants. Output of frozen fries in 2018 hit 2,073,747 tons, up from 1,770,298 tons in 2017. Refrigerated, or chilled fry tonnage, was 231,734 last year, compared with 226,796 in 2017. The figures for mashed potato products, croquettes, chips, flakes and other items were 695,321 tons in 2018 and 690,159 tons in 2017.

The term “Belgian fries” is increasingly recognizable among consumers around the world, who regard it positively along with other Belgian food and beverage fare including chocolate, waffles, beer and ale. It took the coordinated efforts of Belgium’s potato production and marketing cluster to make it happen.

In addition to growers, for whom potatoes have become the most important source of revenues within the nation’s arable farming field, service providers and suppliers of machinery have also experienced remarkable growth. They are increasingly leading global players in innovative product introductions and technology advances.

The Belgian potato processing industry is based in the heart of the European production belt. It can thus not only draw from a deep regional pool of talent and expertise, but is also well positioned to maximize efficient logistical networks connected to international ports.

Rising Investment, Jobs, Sustainability

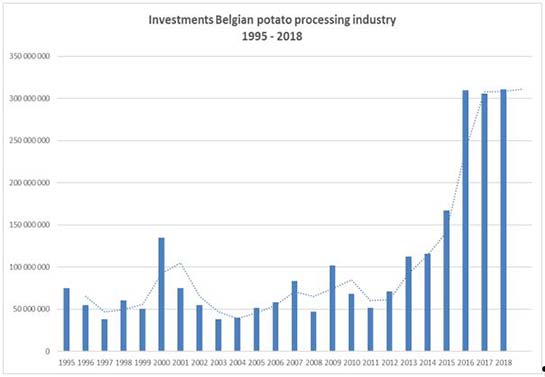

Investments in the future continue to be made, both with regard to quality and quantity. Sustainability is the recurring theme through it all. Efforts are being made in the area of the sustainable cultivation of potatoes, environmentally friendly production and logistics.

The processing sector’s employment rate has also charted remarkable growth, showing an increase of 8% compared to 2017. At present, 4,762 blue- and white-collar workers are gainfully engaged in highly automated factories and offices.

As for the foreseeable future, the sustainable growth of Belgium’s potato processing industry seems assured. In 2018 there were record investments in the area, amounting to almost €311 million.

The reasons for this remarkable evolution are firstly the continued rising demand for potato products on the global market. Growing middle classes in Asia and South America are stimulating appetites for convenience foods, including Belgian fries.

The Belgian potato sector made use of the large supply of tubers in the second half of the 2017-2018 growing season, following a record potato harvest. Despite the setback of the 2018-2019 season, which coped with exceptional drought and repeated heat waves, a large supply of potatoes became available in the second half of 2018. As quite a number of batches could not be kept, in consultation with the growers it was decided to process them in the autumn of 2018.

In addition, the Belgian processing companies are also increasingly investing in promotion and developing their commercial network. One example of this is the campaign in Southeast Asia in cooperation with VLAM, APAQ-W and the European Commission. It has led to better familiarity with the story of “Belgian fries, from the heart of Europe” in Vietnam, Thailand and other countries in that part of the world.

Not All News Good

Meanwhile, the prolonged drought and high temperatures during the 2018-2019 growing season caused extensive damage to the Belgian potato chain. Not only will the low yield of the 2018 harvest probably have a major impact on the business results of all national players, but the confidence in this strong, largely family-run sector of SMEs developed over many years has been shaken.

Agricultural organizations and Belgapom have as much as possible stimulated dialogue between the companies executing contracts. They are also continuing to focus on achieving a trade organization for the potato sector that should provide a fixed base for this dialogue.

Agricultural organizations and Belgapom have as much as possible stimulated dialogue between the companies executing contracts. They are also continuing to focus on achieving a trade organization for the potato sector that should provide a fixed base for this dialogue.

“Trade and industrial sectors have furthermore adapted their quality requirements as part of the solution to the problems, although admittedly this has led to shorter fries,” reported Belgapom.

The high potato prices on the free market led to a rising price for finished products, which did not have a favorable impact on the Belgian competitive position vis-à-vis other producing nations.

In addition, the Belgian and European industries are working together to convince the European Commission to “make a forceful end to the unfair antidumping measures of a number of countries,” stated Belgapom. “Not only do they damage the companies involved, in addition an unjustified negative image is affecting this dynamic sector, one which developed into a global player without systematic support from the government.”

The difficult circumstances of the 2018-2019 season also have an impact on the amount and quality of the seed potatoes supplied, which could very well affect the next season.

Finally, the sector is also regarding the imminent decision of the European Commission to no longer permit the sprout inhibitor CIPC with great uncertainty.

“This substance has been in use since time immemorial,” stated Belgapom. “Recent studies will perhaps result in its authorization being revoked. Luckily the sector itself, in collaboration with Flanders Food, has already taken the initiative to examine alternative substances with the Reskia research project (low-residue sprout inhibition). However, it is still necessary to learn how to handle this in practice and the sector will be confronted with significant investments in potato storage.”

Belgapom has called on the Flemish and Walloon authorities to assist and support their producers in this effort. The sector expects full cooperation from Europe to also find a solution for risks as a result of the historical contamination of warehouses.

WatchITgrow Support

Within the framework of sustainable development of the sector, Belgapom and its companies are offering their full support to VITO’s WatchITgrow platform. This instrument, that makes use of satellite data and numerous other information sources, is the successor to the Belspo Ipot project that Belgapom helped to set up.

The trade association has called on its members to pay a premium to producers who, within the framework of their contract enter their parcels via WatchITgrow before 2019 and add the necessary cultivation data.

The data is used by VITO to develop growing advice controlled by AI (artificial intelligence). For the next two years, growers can make use of the online growing advice that will be further developed year after year. After that, a fee will be charged for the system, but it will also continue to further develop its advice and warnings.

Access to the harvest prognosis model is limited to just the grower, who is free to share it with buyers if desired. It should be pointed out that VITO is the only party that has direct access to this data.