The Harrisburg, Pennsylvania, USA-headquartered National Frozen & Refrigerated Foods Association (NFRA) recently released its State of the Industry Report providing broad-based insights that show how the frozen and refrigerated foods categories attract consumers, drive shopping trips, build shopping basket dollars and deliver sales.

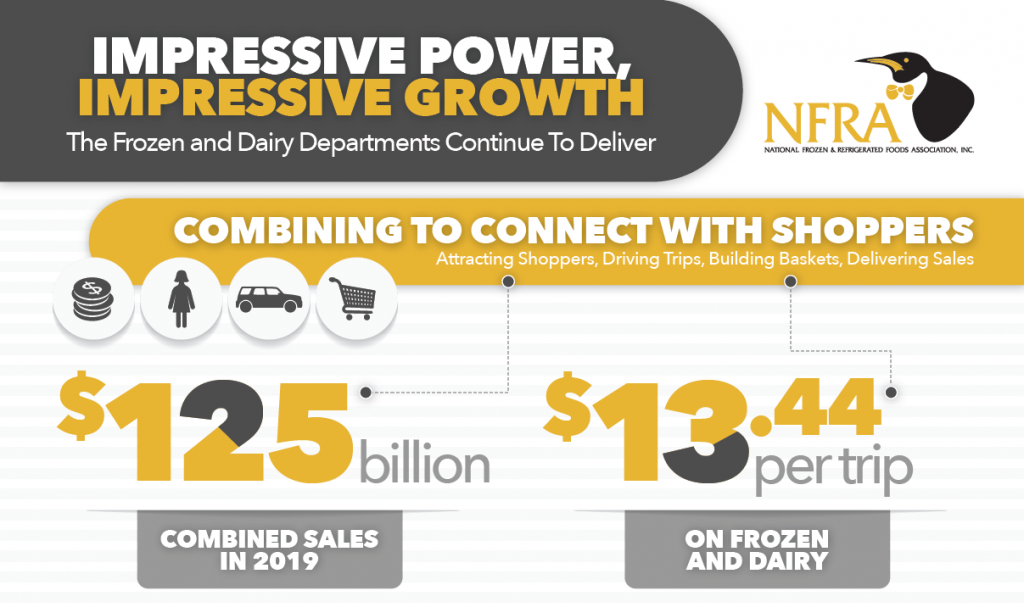

Today’s frozen and dairy departments are clearly connecting with shoppers showing combined sales of $125 billion in the 52 weeks ending June 29, 2019. Nearly every US household buys from the frozen and dairy departments annually, and the diverse appeal of these products crosses generational, multicultural and socio-economic demographics.

With an average buying frequency of 70 trips per year, shoppers are coming to the store more than once a week to make a purchase from the frozen and dairy aisles. The average frozen and dairy department shopper spends $13.44 per trip – making these departments important for increasing the dollar sales of each shopping basket.

“Both the frozen and dairy departments have strong, broad appeal among consumers with the potential to drive short- and long-term growth for retailers. In 2019, dollar and unit sales increased in both departments attesting to consumers’ renewed excitement about the innovative products they can find there,” said NFRA President and CEO Skip Shaw.

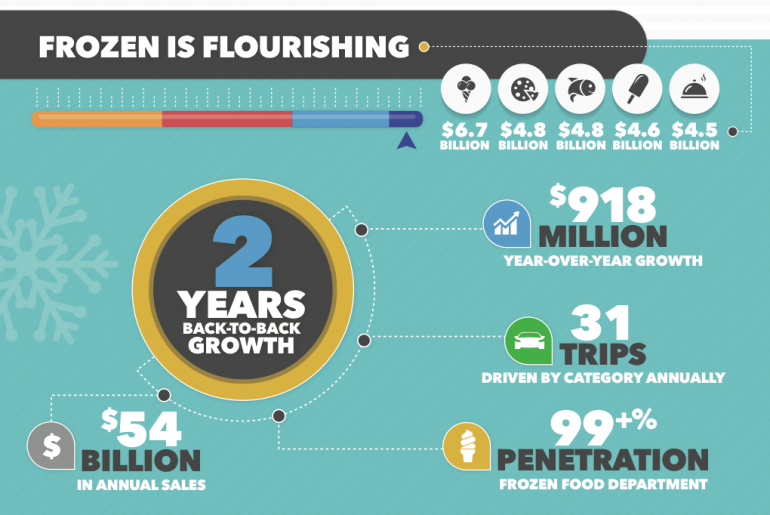

Ice Cream, Pizza, Seafood Top Three in $54.6 Billion Frozen Sales

The frozen department showed two years of back-to-back growth with sales of $54.6 billion delivering $918 million in growth. The top-five selling frozen department categories were ice cream ($6.7 billion), pizza ($4.8 billion), seafood ($4.8 billion), novelties ($4.6 billion) and complete meals ($4.5 billion). Pizza, seafood, novelties, vegetables and prepared potatoes all showed solid growth with an increased percentage of dollar sales ranging from 3.7 to 5.1 percent versus the prior 52-weeks.

The frozen department drives 31 trips per buying household annually and adds $10.90 to shopping baskets per trip. Ice cream and vegetables are the categories with the highest household penetration, showing up in more than 80% of homes. With half of US households having access to more than one freezer, there is opportunity to take advantage of this extra capacity.

“Frozen foods have seen strong growth over the last few years as innovative products now align with consumers’ demands for organic, plant-based, gluten-free and so much more,” stated Shaw. “NFRA’s consumer PR efforts have been successfully working to tell this positive story about today’s frozen foods.”

$71 Billion in Dairy Sales

The dairy department is the second largest edible department in the supermarket (excluding alcoholic beverages) with sales of $71 billion and delivering $550 million in year-over-year growth. Sixty-eight percent of all dairy department sales are concentrated in the top-five selling categories – cheese ($16.3 billion), milk products ($13.3 billion), beverages ($8.6 billion), yogurt ($7.2 billion) and eggs ($5.8 billion). The three top-selling categories showing meaningful long- and short-term growth are cream and creamers, meal combos and prepared foods.

More than 90% of households purchase cheese, eggs, milk products, butter and margarine. The dairy aisle drives 47 trips per buying household annually with milk products and cheese topping the shopping list. Female head of households aged 35 to 44 years old drive 21% greater sales than other US households.

“Today’s modern dairy aisle has evolved to meet consumers’ changing needs,” said Shaw. “It’s a destination for products that fit every lifestyle including dairy staples, plant-based alternatives and new innovative foods and beverages to satisfy every taste and dietary need.”

Conducted by Nielsen and compiled by Todd Hale, LLC, the NFRA 2019 State of the Industry Report identifies key opportunities to drive sustained growth and ensure the frozen and refrigerated food categories receive the proper level of shelf space and merchandising support they deserve.

NFRA’s complete 400+ page 2019 State of the Industry Report is free to NFRA members as a benefit of membership. The NFRA 2019 State of the Industry Executive Summary is available to the public.