April proved to be a solid month for beef and pork exports from the United States despite Covid-19 related interruptions in production and declining purchasing power of some key trading partners, according to data released by USDA and compiled by the US Meat Export Federation (USMEF). Beef exports were below last April’s large totals but still topped $600 million in value. Pork exports remained well above year-ago levels, but slowed from the record pace established in the first quarter.

“Considering all the challenges the US red meat industry faced in April, export results were encouraging,” said USMEF President and CEO Dan Halstrom. “Exporters lost several days of slaughter and processing due to Covid-19, and shipments to Mexico and some other Latin American markets declined due to slumping currencies and the imposition of stay-at-home orders. But despite these significant headwinds, global demand for US beef and pork remained strong.”

While May export results will likely reflect similar obstacles, Halstrom noted that red meat production continues to recover, setting the stage for a strong second half of 2020.

“International customers are relieved to see US production rebounding, solidifying our position as a reliable supplier,” he said. “This helps address a major concern for buyers, as Covid-19 has disrupted meat production in many countries – not just the United States. Demand remains robust for US red meat, especially at retail, but USMEF is actively working with our foodservice customers across the globe to help ensure a strong recovery for the restaurant, catering and hospitality sectors. Many are adjusting to an entirely new business climate, and the US industry assisting them in this process can help ensure that pork, beef and lamb will be featured on their menus.”

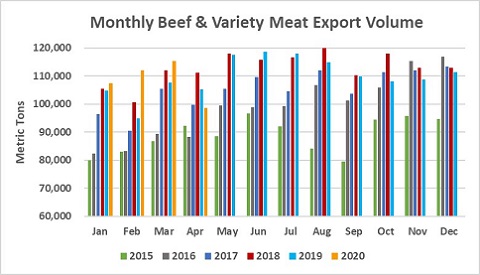

April beef exports were down 6% from a year ago to 98,613 metric tons (mt), with value falling 11% to $600.9 million. But sales growth was strong in Japan thanks to reduced tariffs under the US-Japan Trade Agreement, and trended higher to China following late-March implementation of the US-China Phase One Economic and Trade Agreement. For January through April, beef exports totaled 433,316 mt, up 5% from a year ago, valued at $2.66 billion (up 3%).

With lower April slaughter numbers, beef export value per head of fed slaughter climbed to a record $363.35, up 19% from April 2019. For the first four months of the year, per-head export value increased 5% to $326.47. April beef exports accounted for 15.9% of total production and 13.5% for beef muscle cuts, up from 13.5% and 11.1%, respectively, a year ago. Through April, exports accounted for 14.4% of total beef production and 11.9% for muscle cuts, up from 13.8% and 11.2%, respectively, last year.

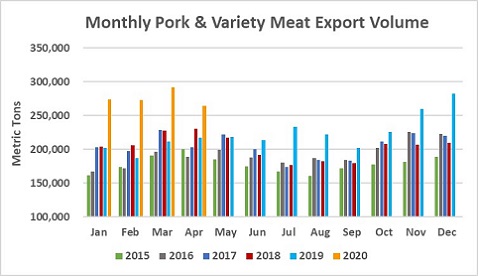

While China/Hong Kong continued to be the pacesetter for US pork export growth, April shipments also increased significantly to Japan, Vietnam and Chile. Volume that month reached 264,048 mt, up 22% from a year ago but the lowest since November 2019. Export value was $682.8 million, up 28% year-over-year but the lowest since October 2019. Through the first four months of 2020, pork exports remain on a record pace at 1.1 million mt, up 35% from a year ago, with value up 45% to $2.91 billion.

With production down significantly from the record levels achieved in March, pork export value per head slaughtered jumped to a record $72.55 in April, up 43% from a year ago. The January-April per-head average was $66.36, up 40%. April exports accounted for 36.2% of total pork production and 32.2% for pork muscle cuts, each up nearly 10 percentage points from a year ago.

Through April, exports accounted for 32.4% of total pork production and 29.3% for muscle cuts, up from 24.9% and 21.8%, respectively, in the first four months of 2019.

US Beef Capitalizing on Market Access Gains in Japan

April beef exports to leading market Japan totaled 31,280 mt, up 30% from a year ago, while value was the highest since August 2018 at $196.4 million (up 25%). Through April, exports to Japan established a record pace at 114,152 mt (up 16% from a year ago) valued at $719.8 million (up 13%).

Although beef exports to South Korea cooled in April, 2020 shipments remained ahead of last year’s record pace. April exports totaled 19,411 mt, down 14% from a year ago, valued at $133.9 million (down 19%). But through April, exports to Korea were still up 6% from a year ago at 83,345 mt, valued at $598.7 million (up 4%). Korea eased social distancing and stay-at-home requirements in May, leading to a significant increase in domestic travel and foodservice demand through the nation’s early May holidays.

Exports to Canada Rebound

After a down year in 2019, demand for US beef has rebounded in Canada. April exports rose 38% from a year ago at 10,850 mt, with value up 35% to $74.7 million. Through April, exports north of the border increased 25% in volume (35,399 mt) and 24% in value ($241.1 million). Canada faced production challenges similar to the US, with sharply reduced slaughter volumes in April and May.

Other January-April highlights for US beef include:

- April exports to Taiwan were steady with last year at 5,093 mt, valued at $47.5 million. Through April, shipments to Taiwan were 12% ahead of last year’s record pace at 20,868 mt, valued at $183.1 million (up 11%). Taiwan is an especially strong destination for chilled US beef, with the United States capturing 74% of that market segment. Taiwan’s imports of chilled US beef have jumped by 25% year-over-year, bolstered by strong retail demand.

- Beef exports to China were by far the largest of the year in April at 1,321 mt, up 82% from a year ago, valued at $11.4 million (up 128%), reflecting market access improvements implemented in late March that expanded the range of US cattle, beef products and processing plants eligible for China. Through April, exports to the PRC were up 34% from a year ago at 3,179 mt, valued at $25.4 million (up 41%). Although inventories of imported grass-fed beef are abundant in China, there is strong demand for American grain-fed beef.

- Exports to Mexico dipped sharply in April due to Covid-19 related restrictions on businesses and consumers and the slumping value of the peso. Through April, exports to Mexico were 9% below last year’s pace at 70,048 mt, valued at $331.4 million (down 11%). But the market south of the border remained the largest volume destination for beef variety meat exports, with shipments up 11% from a year ago at 32,872 mt, valued at $81.7 million (up 3%).

- Africa continues to emerge as growth region for US beef variety meat. Through April, variety meat exports more than doubled from a year ago in both volume (10,091 mt, up 131%) and value ($7.6 million, up 122%), with South Africa, Gabon and Angola as the leading destinations.

Impressive Gains for US Pork in Japan, China/Hong Kong

Similar to beef, US pork exports to Japan are benefiting from a level competitive playing field in 2020, no longer saddled with a tariff disadvantage compared to Canadian and European pork. April exports to Japan totaled 39,232 mt, up 28% from a year ago, valued at $164.2 million (up 39%). Through April, exports reached 142,747 mt, up 16% from a year ago, with value up 20% to $592.5 million.

With the increase in meals eaten at home and children being out of school, US chilled pork has benefited from Japanese consumers’ preference for cooking pork at home. This situation has also stimulated demand for easy-to-cook processed pork products, which include sausages as well as products using US ground seasoned pork as raw material. Japanese import data showed huge volumes from the US in April, pushing January-April imports higher year-over-year in these categories: chilled pork (70,856 mt, +6%), ground seasoned pork (41,154 mt, +56%), frozen pork (20,557 mt, +27%) and sausages (3,174 mt, +14%).

April pork exports to China/Hong Kong set another new record at 116,928 mt, more than triple the year-ago volume and surpassing the previous high reached in December 2019. April export value was $268.5 million (up 284%). Through April, exports to China/Hong Kong continued on a record pace at 413,453 mt, up 223% from a year ago, while value increased 310% to $993 million.

Boxed carcasses accounted for 41% of US export volume for the PRC, with bone-in hams accounting for 10%. So less labor-intensive products made up more than half of this year’s shipments to China, which is critical for processors during these challenging times. Through April, US pork accounted for 19% of China’s 2020 imports, as the European Union remaining the dominant supplier with a 59% market share.

Pork exports to Mexico slowed in April but January-April shipments remained 2% ahead of last year’s pace at 238,108 mt, with value climbing 16% to $413.6 million. The sharp increase in value underscores the importance of duty-free access to Mexico, as most exports in early 2019 were subject to a 20% retaliatory duty, which Mexico removed in late May of last year. Weekly export data indicate Mexico’s buying began to rebound in late May, despite continued exchange rate challenges and other economic headwinds.

Other January-April highlights for U.S. pork include:

- With its domestic pork production heavily impacted by African swine fever, pork exports to Vietnam nearly tripled from a year ago to 5,638 mt (up 191%), with value up 160% to $12.4 million. Vietnam recently announced a reduction in its most-favored-nation tariff rates on imported pork, which will allow frozen US pork cuts to enter at a lower rate (10% rather than 15%) beginning in July. Vietnam’s live hog prices continued to set records in May, averaging around $1.80 per pound, up 151% from a year ago.

- Though slowing in April, pork exports to Central America were still 7% ahead of last year’s record pace at 31,367 mt, with value increasing 17% to $79.9 million. This was driven by solid growth in established markets such as Honduras and Guatemala, as well as a sharp increase in demand in Nicaragua.

- While pork exports to South America have declined in 2020, Chile remains a bright spot with shipments up 35% from a year ago to 19,012 mt, valued at $53.6 million (up 43%). Exports to mainstay market Colombia have slowed this year, due in part to a drop in the Colombian peso’s value. However, pork variety meat exports to Colombia increased 57% to 1,194 mt, valued at $2.5 million (up 31%).

Lamb Muscle Cut Exports Continues to Gain Momentum

US lamb exports have trended lower in 2020 due to declines in demand for variety meat, with January-April shipments down year-over-year in both volume (4,336 mt, down 20%) and value ($7 million, down 24%).

In volume terms, lamb muscle cut exports have gained traction this year, with shipments through April increasing 145% from a year ago to 2,031 mt. Muscle cut value, however, dropped 11% to $4.8 million. Volume growth has been driven by strong demand in Mexico, where exports increased 700% to 1,648 mt, valued at $2 million (up 123%). Muscle exports also increased year-over-year to Egypt and Kuwait.

Complete January-April export results for US beef, pork and lamb are available from USMEF’s statistics Web page.