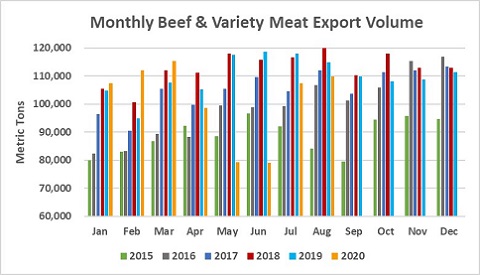

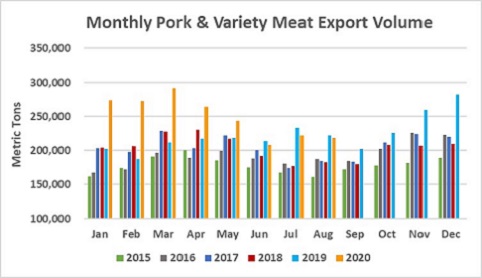

August exports of beef and pork muscle cuts from the United States were above last year’s strong volumes, according to data released by USDA and compiled by the US Meat Export Federation (USMEF). Variety meat exports were lower than a year ago, due in part to the lack of available labor required to harvest and export some items.

Led by record-large demand in South Korea and Taiwan, beef muscle cut exports were the largest in more than a year at 89,148 metric tons (mt), up 3.5% year-over-year, while export value increased slightly from a year ago to $611 million. Combined beef/beef variety meat exports were 109,752 mt in August, down 4.5% from a year ago. Export value was $673.8 million, down 2% from a year ago but the highest since March.

For January through August, beef muscle cut exports were 6% below last year’s pace in volume (627,248 mt) and 9% lower in value ($4.38 billion). Beef/beef variety meat exports were down 8% to 808,659 mt, valued at $4.95 billion (down 9%).

Beef export value per head of fed slaughter averaged $302.82 in August, up 1% from a year ago. The January-August average was down 4% to $297.96. August exports accounted for 13.7% of total beef production and 11.9% for muscle cuts, compared to 14% and 11.3%, respectively, last year. The January-August ratios were 13.3% and 11.1%, down from 14.2% and 11.6% a year ago.

August exports of US pork muscle cuts were 180,369 mt, up 1% from a year ago, though value was down 11% to $448.7 million. Combined pork/pork variety meat exports were down 2% in volume (217,893 mt) and 10% lower in value ($528 million). But pork exports remain on a record pace in 2020, with January-August muscle cut exports up 22% from a year ago to 1.68 million mt, valued at $4.45 billion (up 20%). Pork/pork variety meat exports were up 17% in volume to just under 2 million mt, with value up 18% to $5.13 billion.

Pork export value per head slaughtered averaged $47.47 in August, down 12% from a year ago, but the January-August average was still up 15% to $59.59. August exports accounted for 25.9% of total pork production and 23.1% for muscle cuts, down from 27.2% and 23.7%, respectively, last year. January-August ratios remained well above last year at 30% and 27.3% (compared to 26.4% and 23% in 2019).

“The upward trend in muscle cut exports is very encouraging and especially critical as beef and pork production continue to rebound from the interruptions earlier in the year,” said USMEF President and CEO Dan Halstrom. “Maintaining variety meat volumes has been especially challenging this year, but we continue to expand and develop destinations for these items, which are essential to maximizing carcass value.”

Covid-19 Impact Remains a Factor

Halstrom said the Covid-19 pandemic continues to impact many countries, but the recovery in foodservice is well under way in China and Taiwan and there is progress in other main markets, including Japan and Korea. Even as foodservice activity increases, strong retail and online sales persist.

“Record beef shipments to Korea, Taiwan and China show the kind of rebound US beef can achieve as the foodservice sector gradually recovers and adapts, and we are excited to see demand strengthen further entering the fourth quarter,” he said. “Pork demand is also recovering in some of the regions hardest hit by Covid-19 restrictions, and we see continued export growth in countries where domestic production has been impacted by African swine fever (ASF). US pork is also making significant gains in Japan, including dramatic growth in ground seasoned pork and strong demand for chilled U.S. pork cuts in the regional retail sector.”

Record Beef Exports to Korea and Taiwan

South Korea was the pacesetter for US beef exports in August, setting new records for volume (27,149 mt, up 22% from a year ago) and value ($183.1 million, up 16%). For January through August, exports to Korea were still down 3% in volume (168,262 mt) and 6% in value ($1.18 billion) from last year’s record pace, due in large part to Covid-19 related impacts on the US supply chain, as well as restrictions on Korea’s foodservice operations. Korea gradually eased restrictions this summer but recently re-imposed some social distancing measures, including limits on gatherings and banquets, which have a negative impact on demand for loin cuts.

Beef exports to Taiwan continued to rebound in August, reaching a record 7,439 mt (up 20% from a year ago) valued at $63.8 million (up 8%). These results pulled January-August exports within 1% of last year’s record pace at 42,529 mt. While export value was down 5% at $364.2 million, a strong finish in 2020 could still push exports to Taiwan to an eighth consecutive value record.

August beef exports to Japan were 26,150 mt, down 9% from a year ago, valued at $155 million (down 6%). Through August, exports to Japan were down 4% in volume (209,570 mt) and 2% in value ($1.37 billion). This was due mainly to a sharp decline in variety meat exports, although variety meat volumes have rebounded from the lows posted in May and June, following US supply chain disruptions. For muscle cuts only, January-August exports to Japan increased 4% from a year ago to 180,592 mt, valued at $1.08 billion (down 2%), with beef short plate exports accounting for much of this growth.

Other January-August Beef Market Highlights

- Beef exports to China set another new record in August at 3,886 mt valued at $28.3 million, more than quadrupling last year’s totals. January-August exports to China were 13,148 mt (up 134% from a year ago) valued at $97.3 million (up 118%), already exceeding full-year totals from 2019. Exports to the China/Hong Kong region increased 7% to 64,644 mt, with value up 1% to $518.3 million.

- Following a down year in 2019, beef exports to Canada continue to gain momentum, reaching 74,387 mt (up 13% from a year ago) valued at $505.7 million (up 14%).

- Exports to Africa, a growing destination for beef livers and other variety meats, rebounded in August at 1,733 mt (up 18% from a year ago). Through August, exports to Africa increased 56% in volume (18,729 mt) and 35% in value ($15.8 million), led by growth in South Africa, Cote d’Ivoire, Gabon, Angola and Ethiopia.

- Exports to Indonesia were 2,644 mt in August, up 24% from a year ago, with muscle cut exports setting a new record at 1,837 mt (up 99%). January-August exports totaled 14,208 mt, down 8% from last year’s record pace, valued at $50.1 million (down 1%).

- Foodservice restrictions and a steep decline in tourism continue to weigh heavily on beef exports to Mexico, though July and August volumes were up sharply from the May low. Through August, shipments to Mexico were down 28% from a year ago to 112,598 mt, valued at $493.8 million (down 32%). Mexico is still the largest volume destination for US beef variety meats, though shipments through August were down 9% from a year ago in volume (56,611 mt) and 16% lower in value ($139.4 million).

Pork Exports to Japan Strong; Demand Rebounds in Other Markets

Pork exports to Japan, traditionally the leading value market for US pork, reached 30,247 mt in August – up 7% from a year ago and the largest since April. August export value was $123.5 million, up 3%. For January through August, exports to Japan edged 1% above last year’s pace at 253,362 mt, valued at $1.07 billion (up 4%). Japan’s imports of US ground seasoned pork have rebounded strongly, with value up 48% to $220 million, in reaction to lower tariffs and an increase in Japanese demand for sausages.

August exports to China/Hong Kong fell below the year-ago volume for the first time this year at 61,947 mt (down 3%) valued at $126.2 million (down 8%). August results do not reflect China’s suspension of pork imports from Germany, which was announced Sept. 12 following findings of ASF in wild boars near the Germany-Poland border. Through August, exports to China/Hong Kong still more than doubled last year’s totals in both volume (737,956 mt, up 107%) and value ($1.7 billion, up 136%).

Though August pork exports to Mexico remained below year-ago levels, Mexico reclaimed its position as the largest destination for U.S. pork muscle cuts at 46,462 mt. For January through August, pork/pork variety meat exports to Mexico were 8% below last year’s pace at 435,553 mt, with value down 15% to $701.9 million. Mexico’s demand is critical to the US industry, especially for bone-in hams, of which total exports were record-large in July (61,812 mt) and up 29% from last year in August (54,878 mt). Mexico took nearly 70% of the July-August volume, though exports also increased to China, Canada, the Philippines, Vietnam, Honduras and the Dominican Republic.

Other January-August Highlights for US Pork

- Fueled by surging demand in Vietnam and a recent rebound in the Philippines, exports to the ASEAN region climbed 36% from a year ago to 47,666 mt, valued at $113.6 million. Exports to Vietnam were record large for the second consecutive month in August and January-August shipments more than tripled last year’s pace at 16,323 mt (up 228%) valued at $35 million (up 278%). Following a slow start to the year, exports to the Philippines moved 4% ahead of last year in volume (27,314 mt) and 11% higher in value ($66.5 million).

- Colombia’s demand for US pork continued to recover in August at 5,018 mt – down 13% from a year ago but the largest since March. Following severe economic headwinds earlier this year from Covid-19 restrictions and devaluation of the Colombian peso, January-August exports to Colombia trailed last year’s pace by 38% in both volume (41,117 mt) and value ($89.4 million).

- Strong growth in Honduras and increasing demand in Nicaragua kept pork exports to Central America just below last year’s record pace at 59,979 mt (down 1%). Export value was $145.4 million, also down 1%.

Led by Mexico, Lamb Exports Remain Solid in August

Though down from the large totals posted in July, US lamb exports in August were the second largest of 2020 in both volume (3,129 mt, up 162% from a year ago) and value ($3.04 million, up 65%). Through August, exports climbed 36% above last year to 14,428 mt, though value was down 3% to $17 million. Mexico continues to be the main growth driver for US lamb, but muscle cut exports also trended higher year-over-year to Bermuda, Hong Kong, Japan and Egypt.