Eating In vs Dining Out 2021, the second report in a series that examines the impact of Covid-19 on the food and drink market in the United Kingdom, has been issued by the Watford, England-headquartered Institute of Grocery Distribution (IGA). Its findings quantify how the pandemic shifted spending from foodservice to retail channels in 2020, and the factors that will affect the market this year.

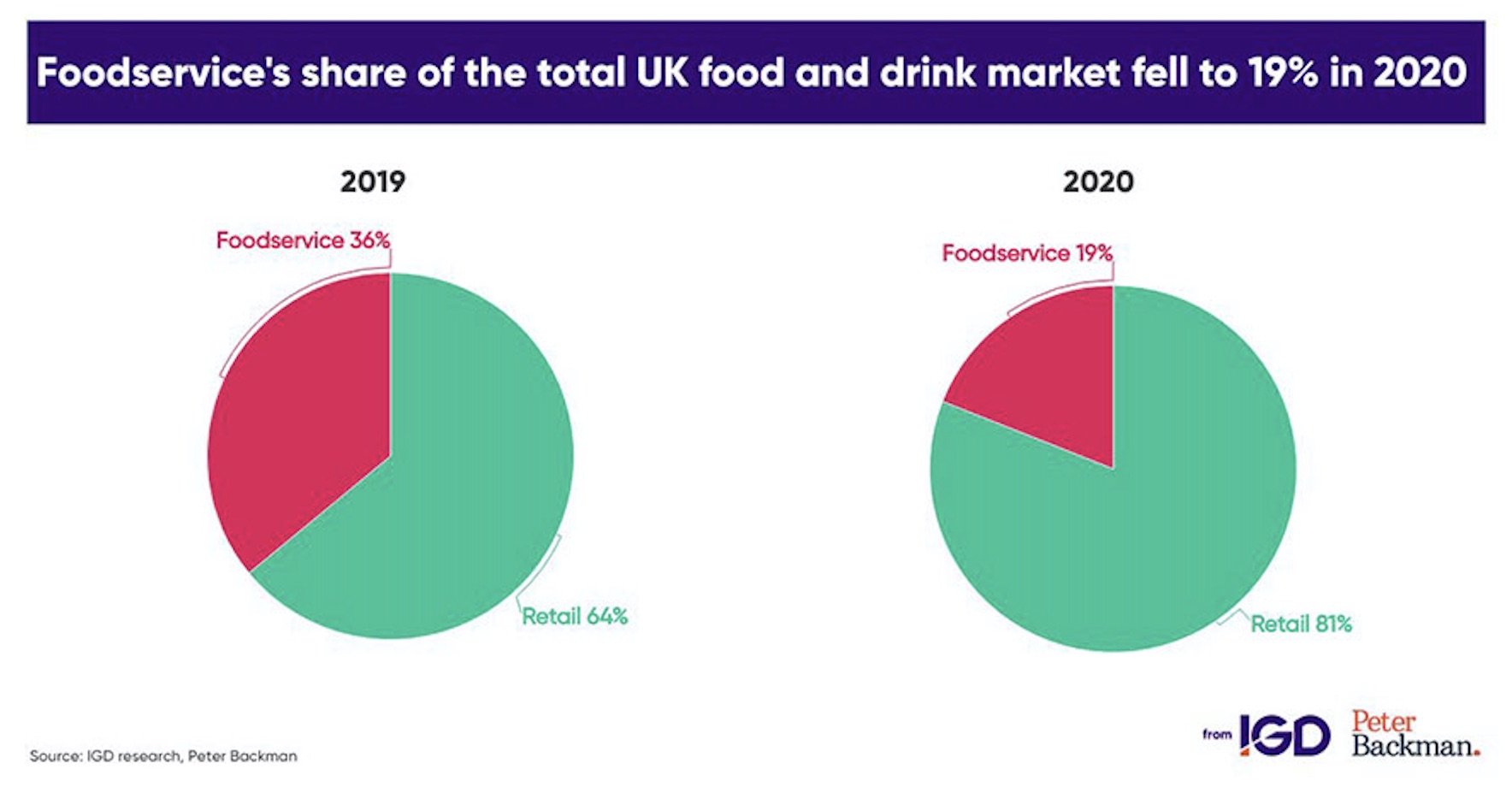

Produced in collaboration with foodservice consultant Peter Backman, the report provides insight into in-home and out-of-home food and drink spending patterns, which saw the grocery retail sector’s share of market grow from 64% in 2019 to 81% last year. Meanwhile, the eating out sector shrank by over 50%.

“Food and drink retail sales grew by 9.9% in 2020, and e-commerce was the clear winner in the sector as shoppers switched to online due to lockdown restrictions and stay-at-home guidance. But the overall food and drink market declined by 12%, predominantly driven by consumers eating more meals at home due to government closures within the eating out sector,” said Nicola Knight, IGD’s senior retail analyst.

Despite restaurant delivery, innovation in relation to meal kits and in-home “experiences,” the research highlights that in general, consumers haven’t been consistently replicating out-of-home habits within the home, contributing to the decline in that market. For example, a steak dinner with all the trimmings in a restaurant can be replaced with a supermarket steak and oven chips for a fraction of the price or traded for a lower value dish.

The second part of the report assesses the many factors that will shape the UK food and drink market in 2021, which include consumer behavior, government support, supply chain resilience, the lasting impact of the economy and labor market, and Britain’s exit from the European Union.

“The second quarter of 2021 is going to be critical for the eating out market,” said Backman. “Without any current indication of when the industry will reopen or government support, many businesses are sitting on a knife edge. We’ll see property debts, plus substantial hospitality costs due and the end of support measures, which will sadly mean that many businesses will have no choice but to shut up shop.

“That said, the swift rollout of the vaccine and an increase in consumer confidence are likely to paint a brighter picture for the second half of the year.”

In the short term, while eating out remains largely “closed,” the food and grocery retail market will need to deliver for food and drink shoppers that have few alternatives. This will manifest itself in high levels of demand for online service. For out-of-home, the agility with which operators responded in 2020 will need to continue in the face of continued unpredictability.

“With normality hopefully beginning to return in the second half of the year, we’re expecting to see a return to some pre-Covid shopping habits, albeit with some more frugal habits emerging,” commented Knight. “2021 is going to be another interesting year of shifting behaviors and spend. We’re delighted to be working with Peter Backman, so that we can look at the market in its entirety, rather than the ‘retail’ and ‘hospitality’ silos that have historically shaped the food and drink industry. It’s a fresh, new approach.”

The report takes a quarter-by-quarter view on the potential outlook for 2021 to help retailers, operators and suppliers begin to plan for the next 12 months. Updates will be launched throughout 2021 in line with the changing landscape.