A return to some pre-coronavirus pandemic (SARS-CoV-2) activities as a result of increased Covid-19 vaccinations and other measures in the US and European markets, along with effective business diversification, helped underpin Thai Union’s solid business growth in the second quarter of this year.

In Q2 2021 the Bangkok-headquarterd seafood company posted sales of THB 35.9 billion, up 8.6 percent from the same time period last year. Thai Union reported a record net profit of THB 2.3 billion, climbing 36.5 percent compared to the Q2 2020, with a gross profit margin of 19 percent.

During the second quarter there was a move back to some pre-pandemic activities, such as family gatherings, celebratory events and dining out, in the United States in particular, as well as in parts of Europe. As a result, Thai Union’s foodservice and retail businesses in the US saw a rebound, helping lift the company’s frozen and chilled seafood business to THB 14.9 billion year-on-year in the second quarter of this year, a 28.7 percent increase compared to Q2 2020 when the effects of the pandemic had a strong adverse effect on the restaurant sector. The company also benefitted from strong improvement at its Red Lobster holding, the largest global seafood restaurant chain.

Thai Union continued focusing on high-margin businesses, and the favorable results were buoyed by ongoing strong demand for PetCare, value-added, including the packaging business, and other products as people continued to adopt pets and spend more time at home, feeding and taking care of them, with sales growth of 12.5 percent to THB 5.7 billion.

The return to pre-pandemic activities in some markets in the second quarter following the exceptional demand experienced when the deadly Covid-19 respiratory infections spread from China early last year, resulted in a sales decline of 6.8 percent in the company’s ambient seafood business to THB 15.3 million in Q2 2021.

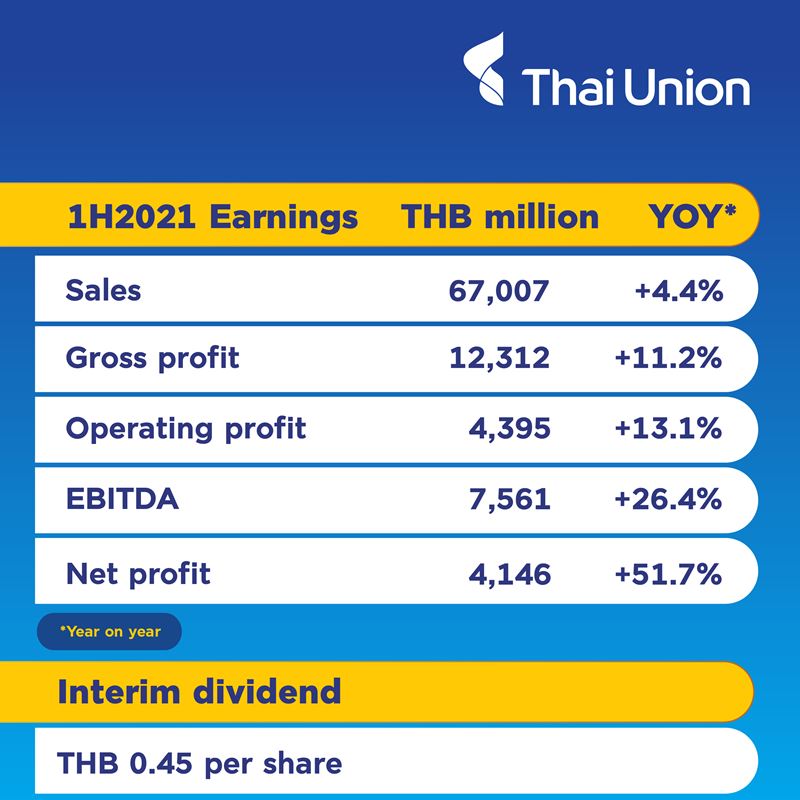

Looking at the first half of 2021, sales grew 4.4 percent to THB 67 billion, with net profit rising 51.7 percent to THB 4.1 billion. The company also declared an interim dividend payment of THB 0.45 per share.

“The diversification in our business in terms of geographical markets, product categories and source of revenues is a key contributor to our strong performance in this quarter, and we continue to focus on profitability, financial disciplines and new, value-enhancing businesses,” said CEO Thiraphong Chansiri. “While demand in our ambient business returned to more normalized levels, our frozen and chilled seafood business recovered strongly on the back of the return to pre-Covid activities in certain core markets.”

Ongoing Investments and Business Diversification

In May, the company acquired the remaining 49 percent of shares of Rügen Fisch AG headquartered in northeast Germany. The shelf-stable seafood company currently generates in excess of €140 million per annum.

In the first half of 2021, Thai Union continued its strategy of investing in new and innovative businesses and start-ups, including in ViAqua, a biotechnology enterprise focused on disease prevention in the aquaculture sector; BlueNalu, a company developing cell-cultivated seafood; and Aleph Farms, a developer of cell-cultivated meat.

“We want to give our customers as many options as possible to help them make choices that enable healthy living and support healthy oceans,” said Chansiri. “We are seeing young consumers across the globe increasingly introduce more plant-based foods into their diets, while still eating fish and meat. Alternative proteins produce less carbon emission and are an important part of our diets globally and therefore to Thai Union’s business.”