The Washington, DC-headquartered National Restaurant Association sent a letter to Congressional leaders on September 29 sharing discouraging new operator survey findings and warning of harm that provisions of the Build Back Better Act (BBBA) could inflict on restaurant industry rebuilding.

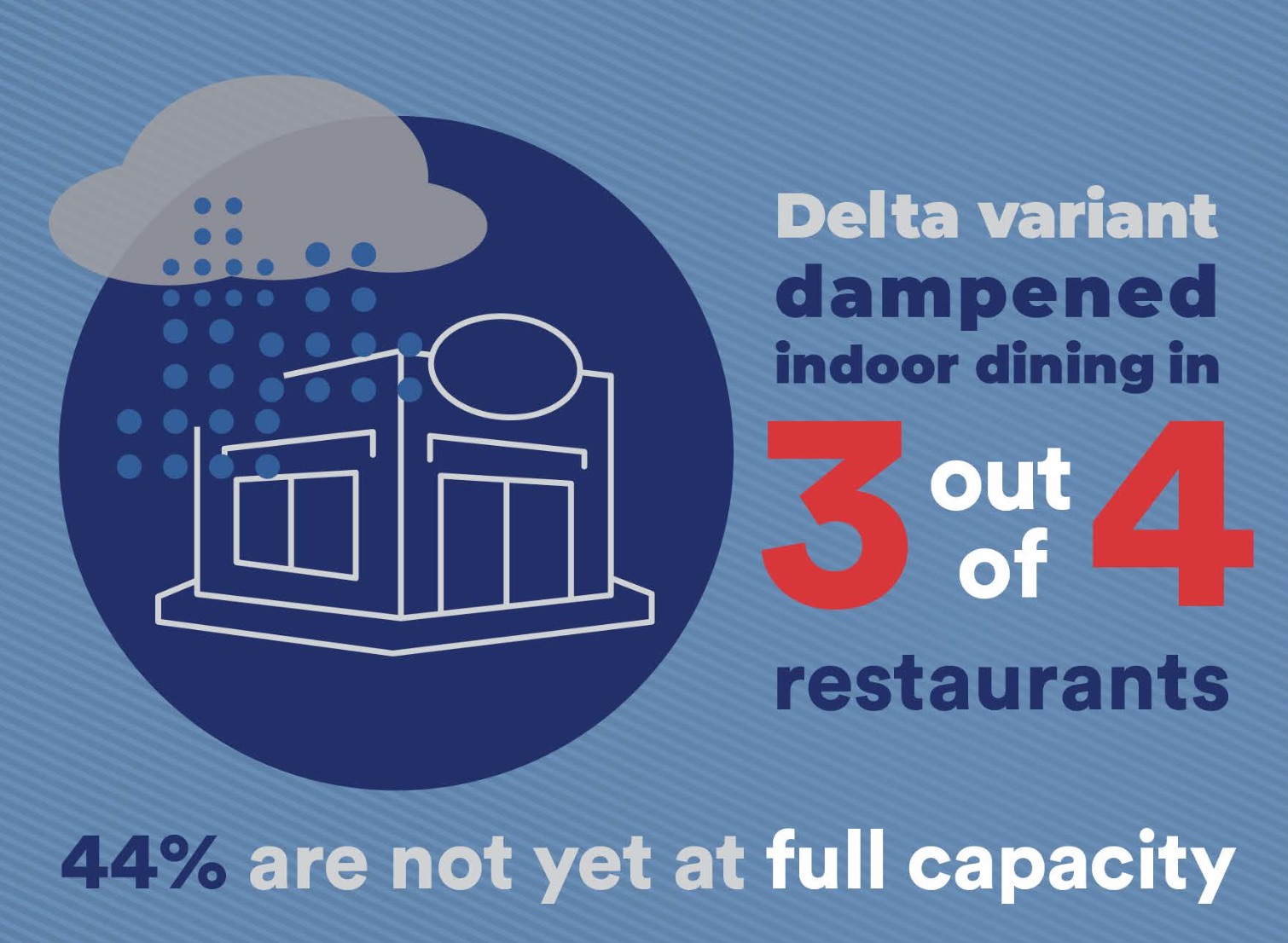

In a new national survey of restaurant operators, research indicates that deteriorating business conditions are impacting operators’ outlook in such a way that they believe a recovery from the coronavirus pandemic will be prolonged well into 2022. Overall, a majority of full service and limited service operators say business conditions are worse now than three months ago. Additionally, 44% of operators think it will be more than a year before business conditions return to normal, and 19% believe they never will.

The survey also found:

•78% of operators say their restaurant experienced a decline in customer demand for indoor, on-premises dining in recent weeks because of the Delta Variant spike.

•63% of operators say their sales volume in August, historically one of the busiest months for restaurants, was lower than it was in August 2019.

•Costs are up – 91% of operators are paying more for food; 84% have higher labor costs; 63% are paying higher occupancy costs – but profitability is down; 85% of operators reported smaller margins than before the pandemic.

•Although the industry has added back many of the jobs lost during the height of the pandemic, 78% of operators say their restaurant doesn’t have enough employees to support current customer demand.

•95% of restaurant operators say their restaurant experienced supply delays or shortages of key food or beverage items during the past three months.

“Our nation’s restaurant recovery is officially moving in reverse,” said Sean Kennedy, executive vice president of public affairs for the National Restaurant Association. “The lingering effects of the Delta Variant are a further drag on an industry struggling with rising costs and falling revenue. We support many of the goals of the Build Back Better Act, but the legislation is too large and too expensive a check for small businesses to take on. Restaurants still need help today and overwhelming them with costly new obligations will only prevent progress in turning the tide of recovery.”

The letter outlined the Association opposition to several tax changes being considered as part of the budget reconciliation bill that significantly increase tax obligations and an effort to make drastic changes to the enforcement of the National Labor Relations Act (NLRA). It also urged Congress to replenish the Restaurant Revitalization Fund (RRF).

Specifically, the Association opposes:

• Any cap on the Section 199A Small Business Tax Deduction, which would deny small businesses earning over $400,000 or $500,000 in annual income the ability to preserve more of their working capital. Capping the Sec. 199A deduction would worsen the ongoing financial struggle of many small and midsize restaurants and inhibit restaurants’ growth in the years to come.

• The repeal of the stepped-up basis, which would make death a taxable event for family-owned businesses. If implemented, this would lead to a restaurant reducing operations, scaling back employment, and selling off assets or locations—causing more heartbreak in the community it serves.

• An increase in the corporate tax rate will cost companies – including restaurants – over $540 billion. As the second-largest private sector employer in the nation, restaurants will have fewer opportunities to invest in employee growth and expansion.

• The addition of fines for NLRA violations, which would overturn 85 years of precedent. Allowing fines of $50,000 to $100,000 for each labor violation upsets the longstanding and well-established balance in labor management law.