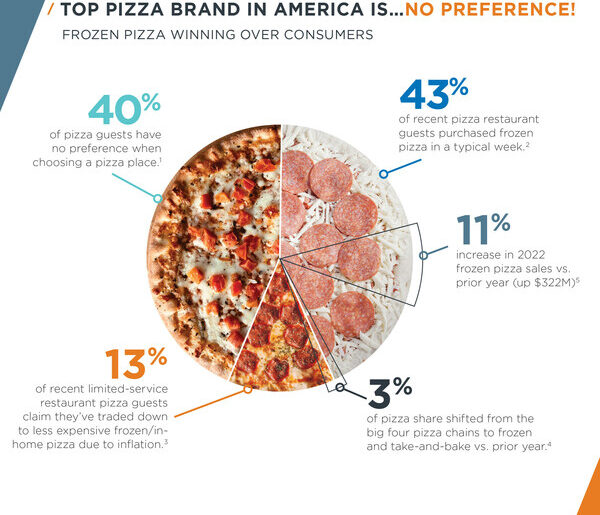

Americans love pizza and consume more than three billion a year. But according to research from Prosper Insights & Analytics, about 40% of consumers now have no preference when choosing a pizza place, and due to inflation, 13% of recent pizza restaurant guests are opting for frozen or non-restaurant pizza.

“Based on sales and traffic numbers, some believe the big four pizza brands (Dominos, Pizza Hut, Papa John’s and Little Caesars) are consumers’ first pick, but when we dig a little deeper, we found that ‘no preference’ is actually the top choice,” said Dana Baggett, client strategy director, restaurant division at San Antonio, Texas-based Vericast. “This lack of preference and loyalty means consumers can be swayed to change brands with incentives.”

Frozen Pizza Sales Up 11%

With inflation top of mind, shoppers are more price conscious and grocery stores are elevating their pizza incentives. Over the past two years, according to Numerator Promotions Intel data collected during 12 months through September 30, 2022, retailers have increased their frozen pizza brand promotions 214% and consumers have noticed. In a typical week, 43% of recent pizza restaurant guests purchased frozen pizza, according to Scarborough Multi-Market. This swing to at-home pizza options is further evidenced by a nearly 11% growth in frozen pizza sales over the last year. As a result, retailers are cashing in, boosting share of wallet.

“The pizza battle is on, and grocery stores are winning,” continued Baggett. “Consumers are shifting to at-home pizza, resulting in the big four pizza players losing 3% share of wallet compared to same time last year, according to Numerator. If they convert just 5% of their guests who purchase frozen pizza each month, they could earn roughly $500 million collectively. Brands who deliver targeted offers across digital and print channels will win loyalty and business.”

![]()

Rising Prices Continue to Affect Consumers

Vericast’s 2023 Restaurant TrendWatch report, which surveyed nearly 2,000 adults in the United States to assess shifting consumer behavior, found nearly half are eating out less often due to inflation. In addition, 18% of consumers, especially millennials, the parents of millennials, and parents overall, are opting for less expensive brands of pizza or restaurants. This behavior increases among frequent pizza restaurant customers – those that order from restaurants once a week or more – with 25% selecting less expensive pizza options.

Other Key Report Findings

Most consumers (64%) surveyed agree rising prices are making restaurant dining too expensive. However, 41% of those surveyed note that with food prices rising at grocery stores, it is not necessarily cheaper to eat at home.

As a result, shoppers are trading down and looking for deals. Half (50%) say coupons and discounts help them choose between restaurants, and these same savings can entice 53% to try a new restaurant.

This presents an opportunity for pizza brands – and grocers and restaurants alike – to offer incentives to be top of mind when hunger strikes.

Coupons and Loyalty Rewards Get Results

42% of those that order from restaurants once a week or more use Save Direct Mail to decide where to dine, and nearly 80% say they spend more at a restaurant when they have a coupon or discount.

58% of frequent pizza consumers said that in the past 30 days a coupon or discount changed where they decided to dine or order.

If a restaurant does not reward loyalty with coupons and discounts, consumers will switch to one that does. This has increased since 2021, driven by a 9-percentage-point increase among Gen Z consumers.

Vericast is a partner to 170 pizza companies including all the top 10 brands in America. To learn more about how inflation is impacting consumers and the adjustments restaurants and retailers can make to optimize their marketing campaigns, read the 2023 Restaurant TrendWatch report.