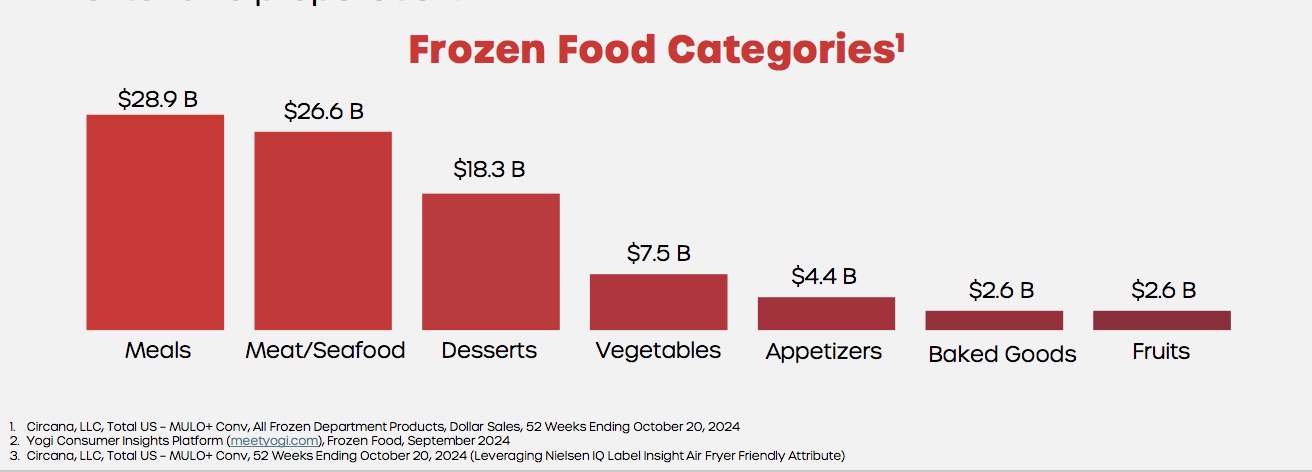

The increase in GLP-1 use, appetites for spice and heat, and indulgent in-home dining experiences are just some of the trends driving growth identified in Conagra Brands’ second annual Future of Frozen Food 2025 report. This data-driven document reveals how consumer behaviors, generational preferences, and innovations are reshaping the $91.3 billion frozen food market in the United States.

Conagra’s Demand Science team leveraged insights from Circana, social media trends from Tastewise, and search trends from Similarweb to develop the 2025 report. The paper highlights five transformative trends driving the future of the frozen food department, along with additional information reflecting how and what frozen foods are being consumed.

“An increasingly diverse array of frozen foods are available, reflective of the overall shifts in what US consumers are eating. New insights point to evolving generational habits and preferences. As Millennials and Gen Z enter family formation years convenience and affordability become the priority, driving a 54% increase in spending on frozen foods during this period,” said Bob Nolan, senior vice president of demand science at Chicago, Illinois-headquartered Conagra Brands.

2025 Emerging Trends

While Conagra is a leader in the United States frozen food marketplace [among its popular brands are Birds Eye, Healthy Choice, Banquet,Marie Callender’s, Bertoli, Frontera, Evol, Gardein, Earth Balance and Mrs. Paul’s] the data and trends identified reflect the broader US frozen food industry, as detailed below:

Modern Health

Health-conscious consumers are seeking frozen products that cater to gut health, portion control and other dietary needs. Frozen foods with probiotics and nutrient-dense, gut-friendly ingredients have grown 33% during the past three years. New products accommodating the 15 million-plus Americans currently using GLP-1 medication with convenient options are also transforming the category. For persons with a sweet tooth, better-for-you frozen desserts are also on the rise.

Elevated In-Home Experiences

While more people are choosing to stretch their budgets by dining at home, consumers are looking for premium, restaurant-quality options. With an additional 25.6 billion in-home eating occasions since pre-pandemic5, buyers are recreating restaurant dishes at home. Frozen food is meeting this demand by offering premium, chef-inspired, and celebrity-backed products which save on preparation time while providing value, fun and unique experiences.

Global Cuisine

Increasingly diverse flavors continue to grow in the frozen aisle. Indian-inspired meals such as tikka masala and Japanese flavors like teriyaki are booming6, as global street food hit over $543 million in sales value. Younger generations are embracing these tastes and are 24% more likely to purchase globally inspired products.

Bites & Minis

Small but mighty, bites and mini portions continue to soar in popularity, appealing to families and younger consumers. With sales increasing to $2.4 billion and a 31% increase in consumption year-over-year, these products are not only convenient but offer a diverse array of options for any occasion. They’re no longer thought of as just appetizers – 84% are now being enjoyed as meals.

Spice & Heat

Spicy frozen foods are heating up, with US sales surpassing $2.0 billion. Younger generations have a strong preference for spicy foods. In fact, Gen Z is 48% more likely to buy spicy frozen meals. Popular emerging spice profiles, such as gochujang, also reflect the influence of global cuisines on this trend.

The full report can be viewed here: Conagra Brands’ Future of Frozen Food 2025 Report