By John Saulnier, FrozenFoodsBiz Editorial Director

Convenience was always a given, but these days the consistency of good quality, flavor and value of frozen food marketed in retail stores under trusted legacy brands and private labels is appreciated more than ever by consumers around the world. This is especially so as many are now well into 100-plus days of lockdown or quasi house arrest sentences imposed by governments attempting to mitigate death and disease caused by the novel coronavirus (SARS-CoV-2) that originated in China last year and has since spread to virtually the entire planet.

As indoor dining at restaurants has been banned in many countries to limit further contagion, foodservice vendors have suffered commercial setbacks like never before. Retail-oriented suppliers, on the other hand, have been experiencing boom times. Among them is Conagra Brands, which on June 30 reported a quarterly net sales increase of 25.8% to $3.3 billion, as earnings per share more than doubled to $0.75.

Fiscal 2020 full year net sales rose 15.9% to 11.1 billion, and organic net sales increased 5.6%. Gross profit climbed 15.7% to $3.07 billion. Adjusted gross profit increased 14.3% to $3.11 billion, primarily driven by the inclusion of figures from the Pinnacle Foods acquisition, and inclusion of the year’s 53rd week.

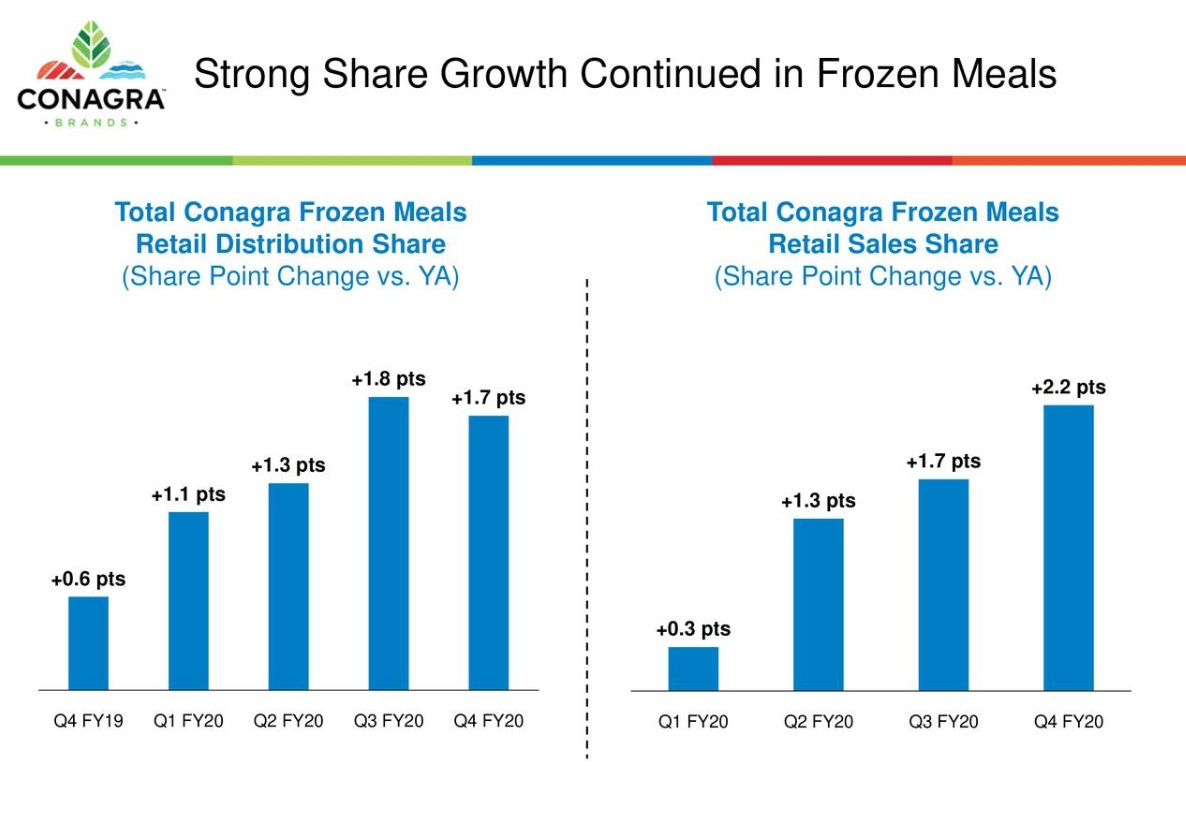

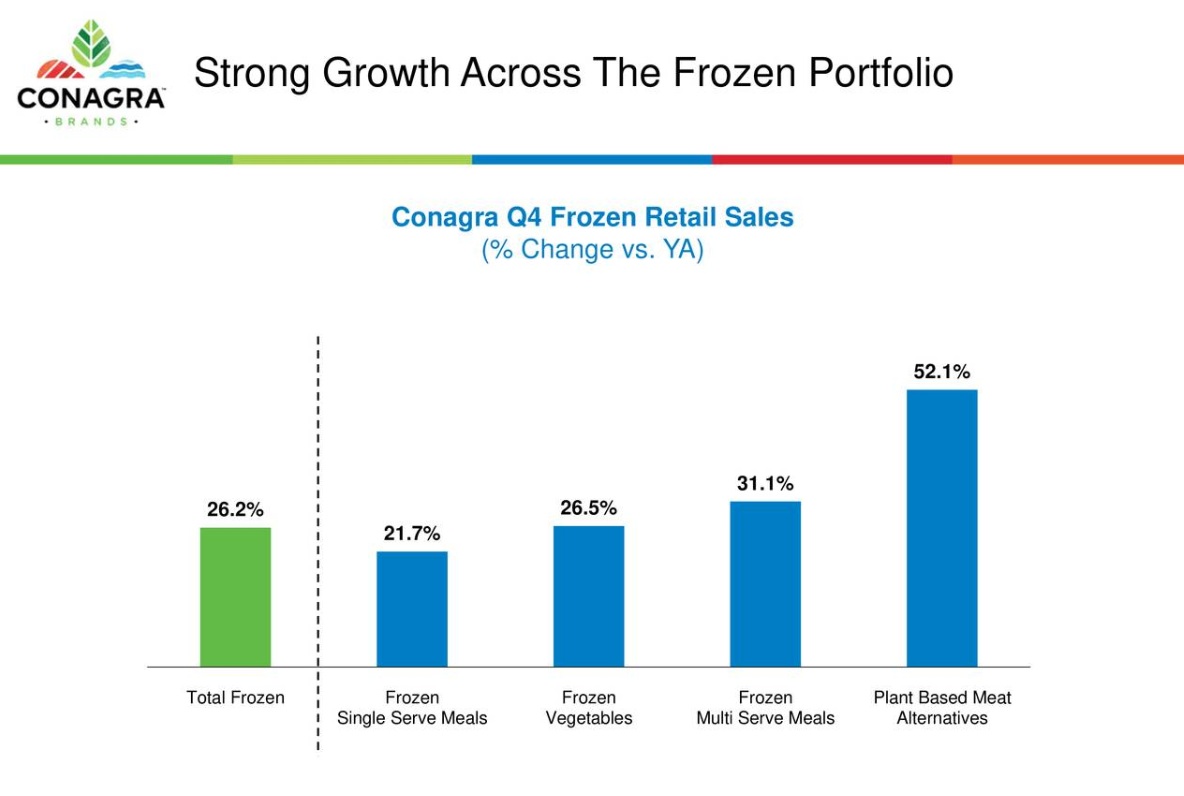

The Chicago-headquartered diversified food company beat Wall Street expectations of $3.1 billion, as it charted double-digit growth in each of its three retail segments. The frozen food sector scored an impressive 26.2% gain, with 21.5% growth logged in organic net sales. Net sales for frozen and refrigerated products were up 23.3% to $1.4 billion in the fourth quarter of fiscal year 2020, which ended on May 31.

“I am very pleased with how our company has responded to the Covid-19 pandemic,” said CEO and President Sean Connolly. “Our business clearly benefited from increased at-home eating in the fourth quarter, as the elevated retail demand outweighed the reduced foodservice demand. In retail, many consumers tried our modernized products for the first time and then returned for more.”

In an earnings call with financial analysts and stockholders, Connolly emphasized that the frozen category “is an increasingly important domain for consumers, especially in today’s environment.” He added that strong growth was achieved across the board in Q4, as sales of single-serve and multi-serve frozen meals respectively advanced 21.7% and 31.1%, while purchases of vegetables climbed 26.5% and sales of plant-based meat alternatives jumped 52.1%.

Birds Eye Soars

“And while the trends have remained strong, there’s even more opportunity – particularly in frozen vegetables,” said the chief executive officer. “Birds Eye faced some unique dynamics in the quarter. We continue to see robust demand for frozen vegetables. Importantly, Birds Eye holds the top position in category share and has two times the share of the next branded player. Given the incredible surge in demand we experienced during the fourth quarter, and our number one brand position, we hit a ceiling on capacity. Furthermore, we made the decision to temporarily close a plant during the quarter due to Covid-19, which further constrained capacity. The good news is the plant is safely back up and running flat out.”

Increases in new customers, repeat buyers and frequency of purchase has been remarkable, according to the Connolly.

“Customers are not just coming back for more, they’re coming back time and time again. And looking to the strength of our trial and repeat results on an absolute basis, we are outperforming our peers in terms of new trial,” he said.

“Let’s take frozen as an example. Our Banquet, Healthy Choice and Marie Callender’s brands are leading frozen single serve peers in new buyer acquisition. These new frozen buyers are disproportionately coming from the Millennial and Gen X market segments, similar to what we see in total Conagra trends. We’re attracting new buyers and seeing higher repeat rates in our frozen segment than our peers.”

Home Freezer Space Limitation

As many households in North America continue to maintain relatively high levels of food stocks during the ongoing Covid-19 crisis, excess canned and shelf-stable goods sometimes are even stored in spaces beyond kitchen pantries. But there is generally a limitation on the volume of frozen products that can be kept on hand. Connolly describes this physical dynamic as “holding power of the pantry relative to the holding power of a freezer.”

He elaborated: “Most freezers are actually incredibly limited in space, and that’s one of the governors that you see on frozen. If you had gone to a Home Depot [home improvement store] or a Best Buy [consumer electronics retailer] in the last few months in search of a freezer, you would not have been able to find one. So clearly consumers are recognizing there’s a limit to what they can fit in their freezer. So that’s the governor you have there versus staples.”

Fiscal 2021 Guidance on Hold for Now

Looking ahead, following a very strong fourth quarter performance, the chief executive officer remains optimistic about the long-term implications of recent consumer behavior shifts. However, given the uncertainties of the Covid-19 pandemic, he was not about to offer guidance for the upcoming fiscal year at this time.

“We intend to provide an update on our fiscal 2021 outlook next quarter,” said Connolly. “Clearly, since nobody can accurately predict what will happen with Covid, and the range of outcomes is very wide, calling ’21 with any accuracy is virtually impossible. But when you step back and you look at where we landed ’20, if you look at the momentum of the business, the continued elevated demand, the new trials, the very strong repeat and synergies remaining on track – our view is that it would be hard to argue that we’re not on a path to the ’22 targets…Certainly, these are positive markers and we have elected to invest behind that option.”