Oghma Partners, a London-based corporate finance house, has issued its latest Food and Beverage Sector M&A report. It focuses on the harvesting and culturing of animal cells in vitro that results in product with a similar macronutrient and genetic profile to traditional meat.

Cell-based meats have the potential to become the leading alternative protein, with the possibility to become the greener alternative to traditional agriculture. Potential also exists to streamline food supply chains. As the industry scales and becomes more economically viable, nations with a poorer domestic agriculture base may be able to house their own facilities and produce their own cell-based meats and other cellular products. Nations may also look to cellular agriculture to secure their food, water, and energy security; cellular agriculture is less resource intensive and with a smaller carbon footprint than traditional agriculture.

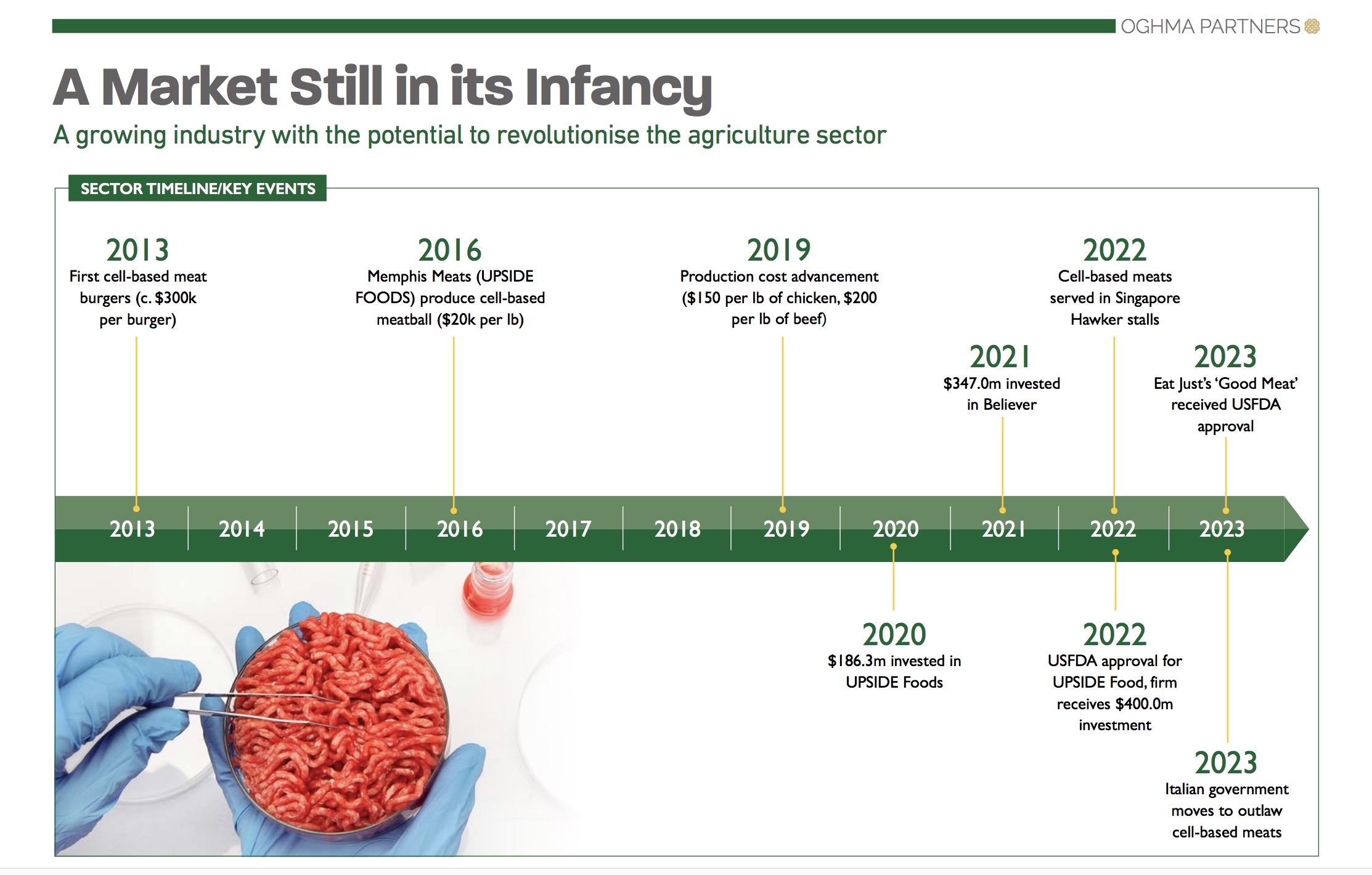

Global cell-based meat start-up activity has exploded rapidly from initial emergence in the late 2010’s with £144.4m invested 2016-2019 (50 companies and 90 deals) to £1,765.3m of investment during 2020-2021 (86 companies and 159 deals). In total Oghma Partners estimates that over £2.6bn has been invested in the cell-based meat area since 2016.

Further highlights of the report include the following:

• A handful of companies have scooped up the lions share of the funding. With Upside Foods £555.1m funds raised representing 21.5% of the global total. In all, the top five cell-based meat manufacturers (Upside Foods, Believer Meats, Wildtype, Aleph Farms and Mosa Meat) account for 46.9% of all funds raised FP 2016-2023YTD. Sixty-eight percent of deal activity is directed toward companies whose activity include the development and production of cell-based meat. With the remaining activity being spread across cell-based seafood (17%), ingredients (11%) and pet food (4%)

• Currently the sale of cell-based meats is regulated and approved in two countries (Singapore and the United States), in which just two companies have regulatory approval; Upside Foods (USA) and Eat Just’s ‘Good Meat’ (USA and Singapore)

• Approval in the United States is a critical development given the size of the consumer market

• Regulatory progress looks promising in many other nations, where governments have already shown interest and support for cell-based meats (including government backed programs in Israel, the United Kingdom, Netherlands and China)

• Many nations have also set out or are developing frameworks by which companies will gain regulation for sales within the market – mostly through existing “novel foods” frameworks. However, not all nations view cell-based meats favorably. The Italian government recently moved to ban any cell-based meat activity within Italy

Potential Alternative to Traditional Agriculture

“A key driver of the rationale behind cell-based protein production is to generate cheap, low carbon protein without the need for antibiotics and in a safe and controlled environment. Cell-based agriculture has therefore, substantial potential as an alternative to traditional agriculture,” said Mark Lynch of Oghma Partners. “We believe that this potential has driven interest and speculative investment into the industry. Significant investment into the cell-based meat industry has led to increasing cap-ex spend with many companies scaling up production capacity and R&D facilities. These investments, some of which are yet to be completed, have the potential to accelerate the launch of products to consumers in the cell-based meat space.”

“However,” Lynch added, “money for new investment is now harder to come by, as the slowdown in funding so far in 2023 demonstrates. The industry will be challenged to deliver sales to consumers and to stretch funding runways to the point of delivering profitability. We see a shake-out similar to that we are seeing in the plant-based meat sector, with consolidation amongst the players most likely.

“The United States is paving the way for the cell-based meats industry globally with the largest number of investors, and producers. A favorable regulatory environment and ease of business is seeing the USA become a hub for industry activity. Multiple overseas companies are looking to relocate or move certain operations to the United States. Israel and the UK are the second and third most active countries, after the USA, in terms of the level of funding for cell-based meat start-ups which reflects a combination of the level of innovation going on in their respective food industries/universities as well as the capital market pool available, combined with a flexible regulatory environment.”

About Oghma Partners

Oghma Partners is an independent corporate finance advisory firm providing acquisition, divestment, fund-raising and strategy advice to European consumer-focused companies and investors. Its team includes members with extensive investment banking experienced gained in senior roles at leading global investment banks.