The coronavirus (Covid-19) has become a familiar part of the international lexicon in a very short period of time. Since its appearance in Wuhan, China in late 2019, world and government agencies are fearful that the Covid-19 outbreak could turn into the world’s most severe pandemic since the H1N1 influenza of 1918.

As of March 11, more than 117,747 coronavirus cases have been confirmed, resulting in almost 4,300 deaths. China represents approximately 73% of the cases and nearly 68% of the fatalities, however, the virus has spread to 114 countries and territories and the number of cases outside of the PRC is growing at concerning rates. The outbreak is expected to have a major impact on an already tenuous worldwide economy, with economists recently downgrading global GDP expectations anywhere from 0.3% to 0.7% for 2020.

Within the United States, the first confirmed case of coronavirus appeared in mid-January. Since then, the number of confirmed cases in that country has reached 728, resulting in 29 deaths. Healthcare professionals believe there are many more cases, as testing has been sporadic, and that it is not a question of if, but when, the virus will become more widespread.

Relative to US impact, economists can only speculate as we are still in the very early stages. There is no question that the longer the virus is not contained and anxiety persists, few sectors will be spared. The foodservice industry could experience significant challenges, given the strong human element inherent in both preparing meals and the act of dining outside the home, presenting both supply and demand issues for the industry.

Chicago-headquartered global foodservice research and market forecasting company Technomic has developed a whitepaper to provide some understanding to foodservice professionals on the consumer view of Covid-19 and its potential impact on the foodservice industry. Original research was conducted with 1,000 consumers from February 28 to March 2 to best understand their behaviors, attitudes and possible reactions to a more widespread outbreak of Covid-19. It should be noted that there are certainly other far-reaching potential effects, such as those relating to supply chain and employee health, but this discussion will focus on consumer implications.

Coronavirus: The Top News Issue

American consumers are certainly well aware of the Covid-19 situation and outbreak taking hold. Among a number of different current events, more consumers indicate that they are closely following this story than any other story, with the next most-followed story being the Democratic primary elections to nominate a candidate to run for President of the United States, but by 21% fewer consumers compared to coronavirus.

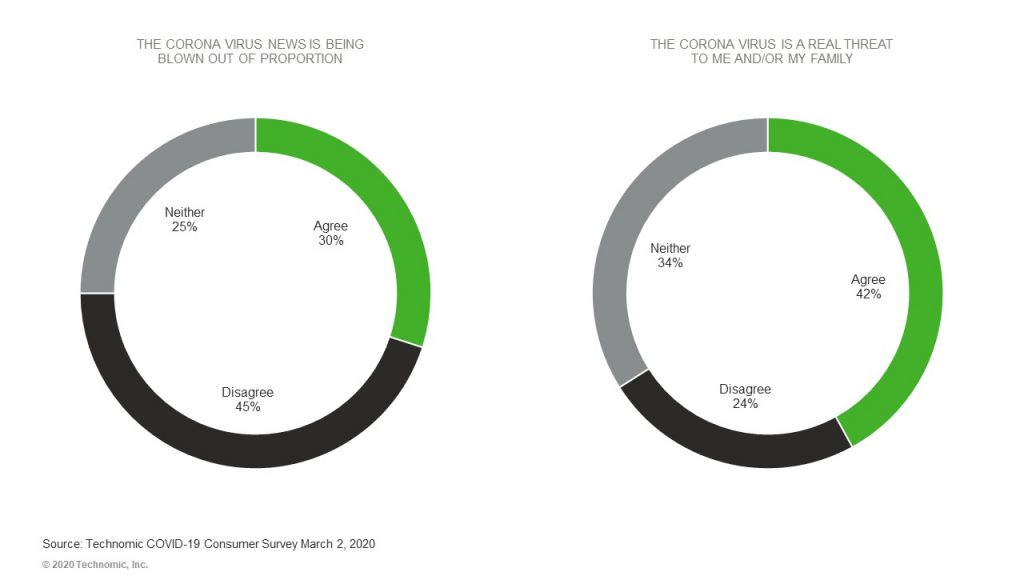

That being said, Americans are somewhat torn on what to think about Covid-19 right now. Overall, 30% believe that the news is being blown out of proportion, with another 25% not knowing what to think about its overall impact. In terms of being a threat to themselves or their families, 42% believe that Covid-19 fits this description, but the remaining 58% disagree or are unsure.

Among Americans following the coronavirus story closely, 86% indicate that this situation is important to them personally, and 82% believe it will eventually have a negative effect on the US economy. So, even though some do not see coronavirus as a health threat to themselves and their families, there are other threats related to personal financial positions and routines about which Americans are concerned.

Consumer Responses

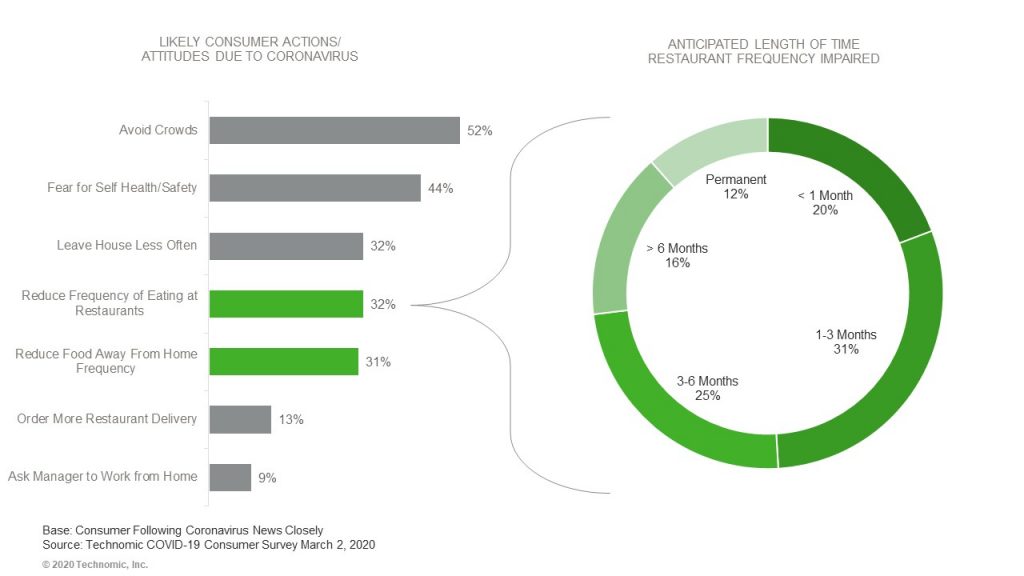

Consumers feel that their behaviors and attitudes are likely to be impacted by ongoing developments. The most likely action is to avoid crowds, which translates into reducing social interactions. More concerning for foodservice, more than three in 10 consumers say they plan on leaving the house less often, not go to restaurants as often or not order food or beverages at away-from-home venues as often. And among those who say they will not go to restaurant as often, 31% say that decreased frequency will last for between one and three months. It is interesting to note that only 13% believe that they will order more via restaurant delivery because of the crisis.

The reduced foodservice visit incidence could be a boon for the grocery business, as almost half of these consumers say they will stockpile grocery foods and beverages as a substitute for away-from-home meals. Meanwhile, other consumers are concerned about their potential need to move away from foodservice due to the crisis as its benefits are ingrained into their lifestyles. These consumers may not have the cooking skills, the time nor the desire to make more meals at home.

What Should the Industry Do

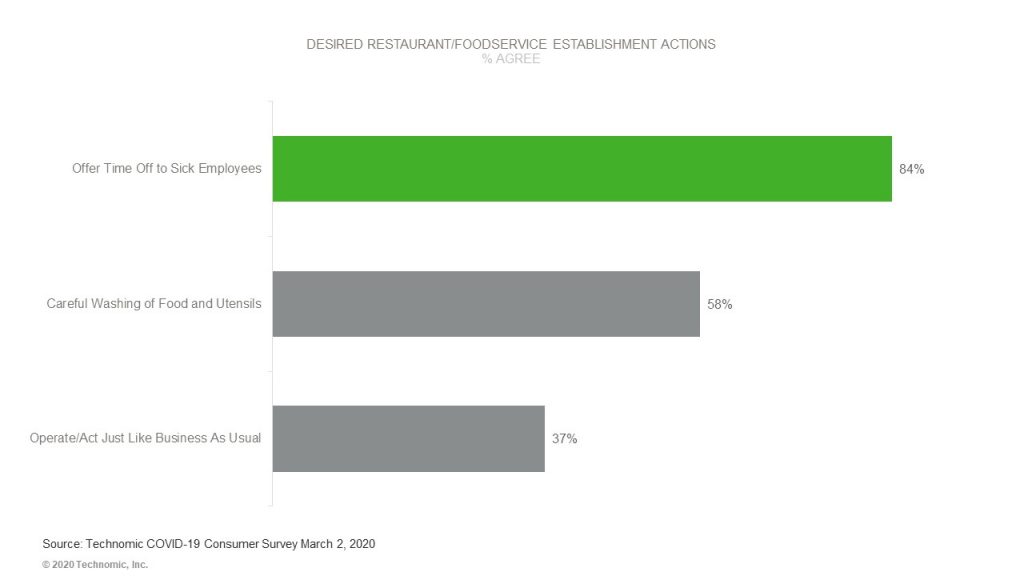

In Technomic’s research, consumers provided their opinions on how the restaurant industry should respond to the coronavirus situation. The top two responses cover mitigating the spread of the virus by providing necessary employees with time off and following proper sanitation procedures. Interestingly, 37% say that restaurants should operate “business as usual.” This indicates that many consumers are satisfied that foodservice operators are as prepared as anyone to mitigate the impact of an outbreak.

Conclusions

There are some very big “unknowns” relative to what impacts the coronavirus will have on the United States economy overall and, specifically, to foodservice at this point. We are in the “too early to tell” phase, as the broader US population had not yet become concerned with this issue until just a week or two ago, when media attention proliferated. Personal consumer and business responses could thwart an otherwise serious widespread outbreak in the US, which would result in social distancing and cocooning. These actions would have effects on foodservice as well.

At this juncture, it is premature for us to determine what growth-related impact Covid-19 will have on the American foodservice industry and its segments, as we are still very much in the beginning stages. However, we have developed some scenarios to consider as the Covid-19 event unfolds in the US. Obviously, the degree of impact will be dependent upon the severity and length of the outbreak in the US, as well as effects on supply chain, availability of healthy staff and other far-reaching industry dynamics.

Potential for Highest Negative Impact

Full-Service Restaurant On-Premise – Consumers could potentially cocoon themselves in their homes and look for eating solutions that will not expose them to unnecessary social interactions. Eating at full-service restaurants certainly can make diners feel vulnerable and would be avoided.

Business & Industry – Many companies are implementing or considering allowing employees to work from home or remotely. Some may temporarily close offices and plants, at least temporarily.

Schools – As of the time this was written, some schools in Washington State have closed due to outbreak concerns. Although makeup days are common, a more prolonged shutdown could result in lost foodservice volume.

Colleges & Universities – This segment faces the same issue as schools, especially as many students live in close quarters. A serious outbreak could cause cancellation of an entire semester. Study trips abroad are being cancelled.

Lodging – Lodging has already been affected, with cancellations from overseas travelers. According to Tourism Economics, the U.S. will lose 1.6 million travelers from mainland China—a drop of 28% from 2019. A drop is expected from other areas as well, as both international and US businesses as well as tourists are already curtailing their travel plans. In the US, companies are evaluating domestic travel bans until the situation becomes clearer.

Recreation – The ultimate in crowd-gathering venues, whether it’s movie theaters, stadiums, cruise lines, concerts halls, amusement parks or museums, this segment could be among the most significantly impacted. Closures, cancellations, and postponements are all being seriously contemplated. Some contingency plans include playing some sporting events in empty stadiums and arenas.

Airlines – As with other travel and leisure segments, the airlines are also feeling the heat and will be impacted as consumers reduce their travel and company travel bans are being enacted.

Potential for Positive Impact

Limited-Service Restaurants – The off-premise nature of limited service, plus the presence of drive-thrus limits human-to-human contact. Delivery-friendly segments, such as pizza, could particularly benefit.

Delivery – As consumers leave their homes less often, potential exists for proliferation of delivery orders through both third-party and self-delivery players.

Supermarket Foodservice – Consumers will still need to visit supermarkets to buy the foods they need on a fairly regular basis. They could potentially increase their purchasing of supermarket foodservice items while grocery shopping as a surrogate for restaurant meals.