Frozen prawn and shrimp product sales are doing well in the United Kingdom retail industry with big players like Iceland Foods “enjoying good growth in prawn products,” according to chain’s category manager, Gareth Thomas. From small value packs of cooked prawns and raw giant king prawns to curries and tempura, UK supermarkets stock a wide range of products for consumers to choose from.

Imports account for the vast majority of shrimp and prawns sold by retail and foodservice operators in Britain. In fact, according to UK Sea Fisheries Statistics, in 2016 imports for shrimp and prawns weighed in at more than 80,000 tons, with most of it coming from Vietnam, Thailand, India and the North Atlantic. Over half of the tonnage is traded in frozen form in the retail sector, according to a recent report issued by Seafish Market Insight (SMI).

Imports account for the vast majority of shrimp and prawns sold by retail and foodservice operators in Britain. In fact, according to UK Sea Fisheries Statistics, in 2016 imports for shrimp and prawns weighed in at more than 80,000 tons, with most of it coming from Vietnam, Thailand, India and the North Atlantic. Over half of the tonnage is traded in frozen form in the retail sector, according to a recent report issued by Seafish Market Insight (SMI).

“We source our coldwater prawns from the icy waters of the North Atlantic and they are quickly frozen to ensure freshness,” said Thomas. “Our king prawns are from carefully selected farms in India and Vietnam.”

Prawns and shrimps are popular with UK consumers, who purchased just over 39,171 tons during the 52 weeks ending on January 26, 2019, equating to a retail value of £526.2 million, reports SMI. This highlights demand in supermarkets, where frozen shrimp and prawns have a 33% value share, while chilled products claim 67% of the market. However, it should be noted that much if not most chilled shrimp and prawns sold in retail display cases or cabinets were previously frozen before being slacked out.

When compared year-on-year to 2018, the value sales of total prawns and shrimps saw growth only in the frozen sector (+9.0%), while declines were experienced in both chilled (-1.8%) and ambient (-99.1%). According to SMI, the whopping drop in ambient sales “looks so out of place because the sector is such a small share in the overall prawn and shrimp retail figures – approximately less than 1%.”

In terms of volume sales, chilled and ambient products recorded declines, while frozen posted a solid growth rate of +6.7%.

The volume growth in the sector can be attributed to the economic climate in which shoppers were looking to save money and frozen products offered significant savings when compared to chilled or ambient products.

Affordability could be an issue in the not too distant future, as Thomas explained:

“Brexit may have an effect on the cost of coldwater prawns entering the UK due to potential import tariffs, coupled with fluctuations in exchange rates, as almost all prawns are imported.”

An increase in the cost of imports could see volume sales stagnate, as the retail industry may be inclined to pass these price hikes onto consumers.

Sustainability

Consumers remain focussed on traceability and sustainability, which is why many of the major high street supermarkets stock certified products. Shrimp and prawn packages carrying the blue MSC (Marine Stewardship Council) label are certified sustainable.

Shrimps and prawns labeled MSC come from fisheries that have been independently assessed to the Marine Stewardship Council’s Fisheries Standard. All companies using the label throughout the supply chain would have been assessed to ensure that their products are traceable back to an MSC-certified fishery.

Shrimps and prawns labeled MSC come from fisheries that have been independently assessed to the Marine Stewardship Council’s Fisheries Standard. All companies using the label throughout the supply chain would have been assessed to ensure that their products are traceable back to an MSC-certified fishery.

Marine Stewardship Council partners include Aldi, Lidl, Tesco and Asda – all of which are committed to selling MSC certified seafood.

“To some consumers the MSC certification is important, which is why Iceland has been holding discussions with the Marine Stewardship Council with a view to extending their accreditation of our frozen fish and seafood range,” said Thomas.

Certification is equally important within the foodservice sector, according to Rhian Hawkings, marketing controller at Gloucestershire-based Creed Foodservice, who commented:

“Choose a wholesaler who promotes the Food for Life Catering Supplier Accreditation from the Soil Association’s Food for Life Catering Mark Scheme, which means that the wholesaler is committed to helping catering businesses improve their food quality, sourcing practices and environmental sustainability. It also means they can offer and supply products which are accredited as organic, free range or have Marine Stewardship Council certification in the case of fish and seafood.

“Caterers should look for MSC certified sustainable seafood. The blue fish label ensuring that the fish can be traced back to a sustainable source can be communicated to consumers on menus to reassure them that only the best quality chilled or frozen fish is being served.”

In the Freezer

According to Technomic, in 2018 prawns and shrimps were the top seafood species listed on small plate dishes in the foodservice sector. They were featured in many popular, on-trend menu offerings such as breaded and tempura fare, as well as linguine recipes. Such trends are very much reflected in supermarkets, with the major players offering prawn and shrimp products in all these guises.

According to Technomic, in 2018 prawns and shrimps were the top seafood species listed on small plate dishes in the foodservice sector. They were featured in many popular, on-trend menu offerings such as breaded and tempura fare, as well as linguine recipes. Such trends are very much reflected in supermarkets, with the major players offering prawn and shrimp products in all these guises.

Iceland sells a Luxury King Prawn Alfredo comprising marinated warm water king prawns with Italian linguine in a single cream, Italian white wine and lemon sauce, priced at a modest £2.69.

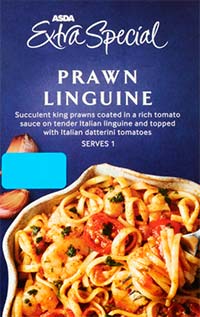

Similarly, Asda stocks a frozen prawn and pasta dish. Single-serve Prawn Linguine from its Extra Special range includes king prawns coated in a rich tomato sauce on tender Italian linguine topped with datterini tomatoes, selling for just £2.55 per 400-gram pack.

Similarly, Asda stocks a frozen prawn and pasta dish. Single-serve Prawn Linguine from its Extra Special range includes king prawns coated in a rich tomato sauce on tender Italian linguine topped with datterini tomatoes, selling for just £2.55 per 400-gram pack.

Asian-inspired tempura prawns are also a popular choice in supermarket frozen food aisles. Morrisons’ 12-pack of tail-on prawns in a crisp tempura batter come in at a reasonable £2, while Sainsbury’s Party Tempura Prawns retail at £2 for a pack of eight.

The frozen natural segment in supermarkets is fairly standard across the board with a selection of both value and premium products. Sainsbury’s offering includes a range of responsibly sourced cooked and raw prawns. The retailer’s basic coldwater prawns cost £2.50 for 250 grams. They are imported from Iceland, the North-East Atlantic, and the North-West Atlantic, and are responsibly sourced from a fishery that has been certified by the MSC.

Asda’s Smart Price cooked coldwater prawns are sourced from Denmark and cost £2.10 for 200 grams. Its Extra Special Jumbo King Prawns cost £2.98 and come from India.

Asda’s Smart Price cooked coldwater prawns are sourced from Denmark and cost £2.10 for 200 grams. Its Extra Special Jumbo King Prawns cost £2.98 and come from India.

Asda states on its website: “We know that nearly 80% of the world fish stocks are fully or partly overexploited (according to the UN). We want to help protect them, which is why conserving North Sea habitats and sourcing from well-managed fisheries is so important to us.”

The latest figures show that the frozen prawn and shrimp sector continues to do well in the UK thanks to discounters such as Aldi and Lidl proving popular with consumers due to price, quality of products and regional sourcing messages. However, the impact of Brexit could burst the bubble if coldwater prawn imports from Denmark and other EU countries are affected and prices increase due to higher tariffs. Then again, as most frozen shrimp sold in Britain is sourced from Asia and thus already subject to tariffs which the market has absorbed for generations with little resistance, the overall impact on consumers’ wallets is likely to be minimal.

For now this sector is thriving, but who knows what the future holds. – Reported by Sarah Welsh