Nearly one year after the Covid-19 pandemic began, a new report finds frozen foods were among the fastest growing categories in grocery stores throughout the United States, with clear signs that Americans’ fondness for frozen products continue to grow.

The American Frozen Food Institute (AFFI) and the Food Marketing Institute (FMI) on February 18 released the second Power of Frozen report during AFFI’s virtual Frozen Food Convention (AFFI-CON). The Power of Frozen 2021 identifies megatrends influencing the demand for frozen foods, including increased engagement in all categories, online shopping and health and well-being.

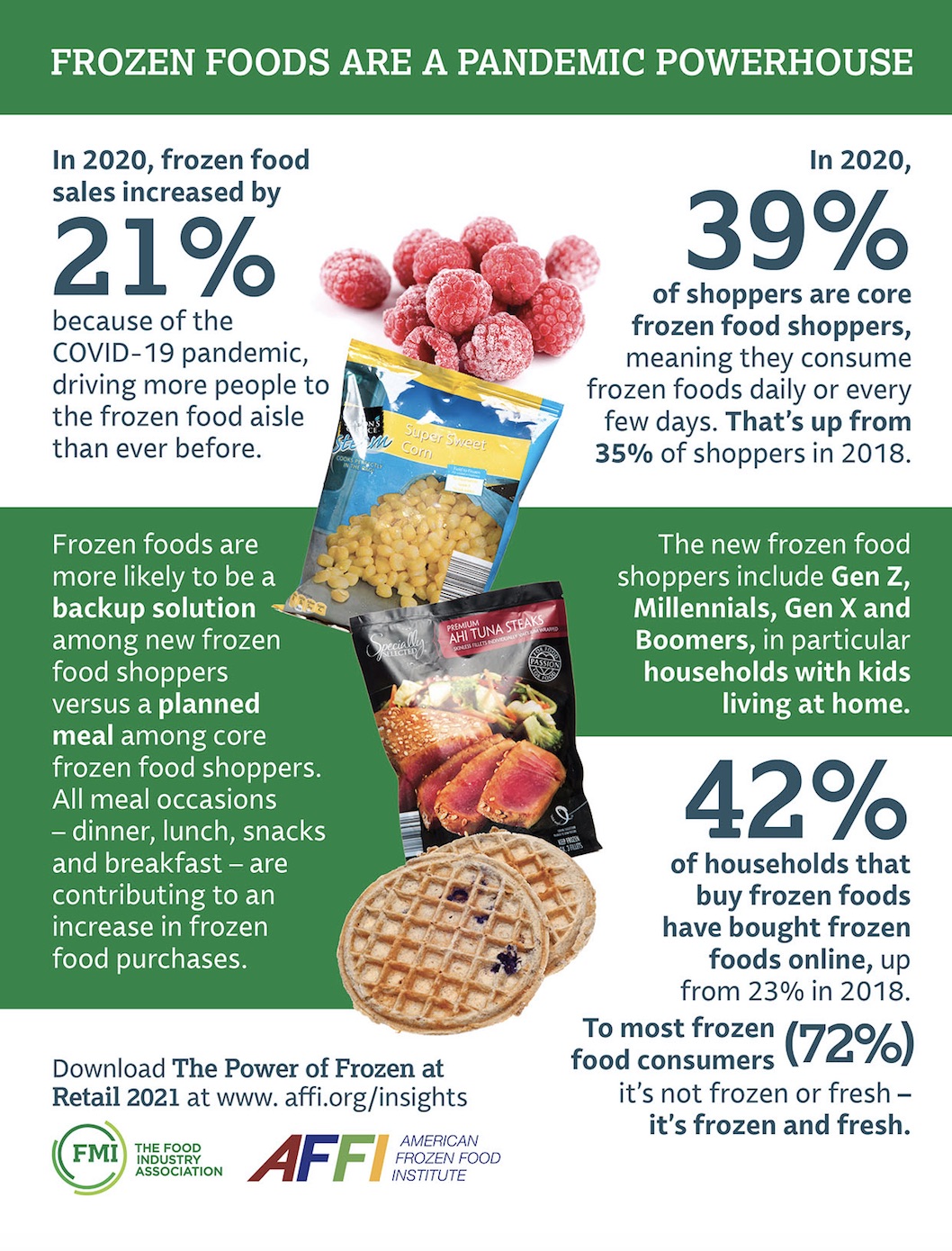

“The frozen food aisle has been a growth driver for retailers since 2016 with acceleration ahead of most other departments,” said AFFI President and CEO Alison Bodor. “Frozen foods are a pandemic powerhouse ringing in $65.1 billion in retail sales in 2020, a 21% increase compared to a year ago.”

Increased Engagement in All Categories

In 2020, frozen food sales grew in both dollars (+21%) and units (+13.3%), with nearly all types of products seeing double-digit sales increases.

“Shoppers are nearly a year into the Covid-19 pandemic and are having more family meals at home than ever before. They are looking for meal plans, culinary creativity and convenient, cost-effective solutions,” said FMI Vice President of Industry Relations Doug Baker. “The frozen foods category offers these benefits to shoppers and that’s why we see all areas – from meal ingredients to meal solutions – reaching new audiences and increasing purchases.”

The top-three frozen food categories with the largest percentage of dollar growth in 2020, according to IRI, include:

•Seafood (+35.3%)

•Poultry (+34.7%)

•Appetizers (+28.9%)

Bodor added, “It’s not just about what’s for dinner, especially for our core frozen food consumers. All meal occasions – dinner, lunch, snacks and breakfast – are contributing to an increase in frozen food purchases.”

Online Shopping

As consumers turned to online shopping at a record rate, the vast majority were adding frozen products to their digital cart. Over the past year, 42% of households that buy frozen foods have bought frozen foods online, up from 23% in 2018. Online frozen food dollar sales increased 75% in 2020, with frozen dinners/entrees, meat, poultry and seafood being the biggest online sellers.

Health and Well-Being

Across many nutrition and production traits, frozen food consumers are most likely to be interested in “real” ingredients, followed by fresh frozen and the absence of artificial colors.

The interest in fresh frozen also aligns with another key finding from the Power of Frozen 2021. To most frozen food consumers (72%), it’s not frozen or fresh – it’s frozen and fresh. “Mixing fresh and frozen in the same meal is a tell-tale trait of our core frozen food consumers,” said Bodor.

Amid the pandemic caused by the novel coronavirus (SARS-CoV-2) the share of core frozen food consumers, defined as those who consume frozen food daily or every few days, rose from 35% in 2018 to 39% in 2020. High-frequency frozen food consumers are more likely than low-frequency consumers to purchase frozen foods for planned, specific occasions.

The Power of Frozen research was conducted by 210 Analytics and funded by Pictsweet, Wawona Frozen Foods, J.R. Simplot Co. and Firestone Pacific Foods.