Global food prices rose for the third consecutive month in August, influenced by generally firmer demand and a weaker US dollar, according to a report released today by the Rome, Italy-headquartered Food and Agriculture Organization (FAO) of the United Nations.

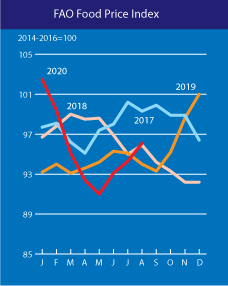

The FAO Food Price Index, which tracks the international prices of the most commonly traded food commodities, averaged 96.1 points in August, up 2.0 percent from the previous month and reaching its highest level since February 2020.

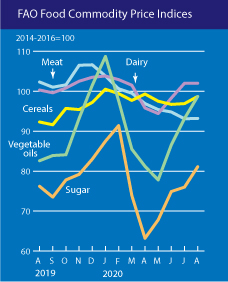

The FAO Cereal Price Index rose by 1.9 percent from July, averaging 7.0 percent above its value in August 2019, with coarse grains leading the rise. Sorghum prices rose 8.6 percent – and stood at 33.4 percent above their year-ago level, mostly on the back of strong import demand by China. Maize prices rose 2.2 percent amid concerns that recent crop damages in Iowa would impact supply. International rice prices also rose, underpinned by seasonally tight availabilities and increasing African demand.

The Sugar Price Index rose by 6.7 percent from the previous month, reflecting reduced production prospects due to unfavorable weather conditions in the European Union and Thailand, the world’s second-largest sugar exporter, as well as strong import demand by China.

The FAO Vegetable Oil Price Index increased by 5.9 percent, led by firmer values for palm oil especially, but also soy, sunflower and rapeseed oils. The moves mainly reflect prospective production slowdowns in leading palm oil producing countries amid firm global import demand.

The Dairy Price Index was virtually unchanged from July, with cheese and whole milk powder quotations declining amid expectations of ample seasonal export availabilities in Oceania, while butter prices rose due to tightening export availabilities in Europe in the wake of the August heat wave reducing milk output.

The Meat Price Index was also almost unchanged since July – although down 8.9 percent from August 2019 – as the effect of lower import demand for bovine, poultry and ovine meats was offset by surging import demand for pig meat from China.

Updated Cereals Outlook

FAO also lowered its forecast for world cereal production in 2020 by 25 million tons from a July projection, due largely to expectations of a lower maize output in the United States. However, despite this reduction, such an outcome would still represent an all-time high, amounting to 58 million tons above the 2019 output.

Record maize harvests are forecast for Argentina and Brazil, while global sorghum production is expected to grow by 6 percent from the previous year. Worldwide rice production in 2020 is also expected to reach a new record of 509 million tons.

FAO’s new forecast for world cereal utilization in 2020/21 stands at 2 764 million tons, up 2.0 percent on an annualized basis

Global cereal stocks are projected to rise by 1.7 percent to 895.5 million tons by close of the 2021 seasons, translating to a world cereal stocks-to-use ratio of 31.8 percent, slightly down from July but still relatively high from a historical perspective.

Buoyed by expected larger shipments of rice and coarse grains, world trade in cereals in 2020/21 is now pegged at 441.4 million tons, 1.6 percent above the 2019/20 level.