Greenyard ended its financial year with solid sales growth and a stronger balance sheet, the Sint-Katelijne-Waver, Belgium-headquartered company reported on June 15. Turnover increased to € 4.416 billion, up 8.7% from € 4 .061 billion generated the year before.

The “rediscovery” of long shelf life frozen and prepared vegetable and fruit products among consumers in Europe locked down during the socially and economically destabilizing coronavirus pandemic (SARS-CoV-2) contributed to the positive result.

“Health is on everyone’s agenda, even more so today,” remarked Hein Deprez, the company’s co-chief executive officer. “This is logical, and fruits and vegetables play a vital role in healthier lifestyles. Therefore, we consider it our responsibility to ensure that these products remain available for our consumers, regardless of the challenges and complexities the pandemic created. Together with our partners, we did so successfully without interruption, and we now look beyond that point.”

Co-CEO Marc Zwaaneveld added: “We had a strong year in all aspects. The group’s organization has been tailored and the mindset and culture changed to meet the changing needs of our customers and end-consumers. The capital structure has been strengthened and the volatility of the profitability significantly reduced. Our performance of AY20/21, the role we have in the food value chain and our scale, are the excellent foundations to accelerate on our ambition to become a driving force for healthier lifestyles and more sustainable food supply chains.”

Key figures in various segments are detailed below.

•Fresh sales amounted to €3,592.7 million, showing double-digit growth (+10.1%) versus €3,263.4 million in the previous year (€329.3m), whereby sales with integrated customers increased by 22.3%. In most markets, retailer volume was stimulated by restrictive Covid-19 measures imposed by local authorities.

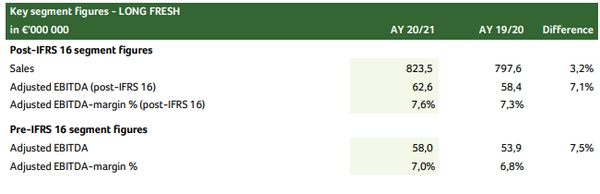

•Long Fresh sales, which include frozen and canned products, increased to €823.5m, up €25.9m from €797.6m (+3.2%), driven by a significant volume increase in retail, new sales contracts and better product mix, partially offset by a temporary loss of volumes in foodservice markets (from 20% share of Long Fresh sales in AY 19/20 to 13% in AY 20/21), induced by the quarantine measures related to Covid-19 that resulted in a shift from out-of-home consumption to at-home consumption.

Adjusted EBITDA Recovery

Greenyard’s adjusted EBITDA (post-IFRS 16) amounted to €156.9m. The company did not record any EBITDA adjustments in relation to Covid-19, as higher margins from extra volumes were more or less offset by extra costs.

The solid increase of €23.5m YoY (+17,6%) is attributable to elements detailed below.

•Fresh: The adjusted EBITDA (post-IFRS 16) continued to grow to €95.1m from € 76.3m, up €18.8m (+24,6%), mainly related to strong volume growth realized through integrated customer relationships. With more than 70% of Fresh segment sales earned via long-term integrated customer relationships, Greenyard has secured the future stability of the margin. In addition, the full-year impact of the transformation initiatives initiated in the previous year as well as newly defined initiatives in the reporting year, including a strong cost control, workforce resizing, efficiency improvements and waste control contributed to the strong margin development of the Fresh segment.

•Long Fresh: the adjusted EBITDA (post-IFRS 16) amounted to €62.6m for AY 20/21 versus €58.4m last year (+7,1%). The further growth is the result of a relentless focus on efficiency improvements, a positive impact of new sales and purchase contracts and an increasing share of sales in higher-end products (higher margin convenience and fruit representing around 30% of Long Fresh sales).

For ease of reference and comparison, excluding IFRS 16 impact, adjusted EBITDA amounted to €116.6m, an increase of €20.9m YoY (+21,8%).