By John Saulnier, FrozenFoodsBiz Editorial Director

As more restaurants in the coronavirius restriction-weary USA start offering or prepare to provide customers limited capacity in-house dining service, Florida is in the forefront of getting back to business and returning to some semblance of normalcy. All the more reason then for KFC to have begun test marketing a new upsized chicken sandwich at 15 Sunshine State outlets in Orlando, Winter Park, Kissimmee, Sanford, Mount Dora, Clermont and Poinciana.

Presented as 20% larger than the Crispy Colonel Sandwich offerings customers are familiar with, the premium grade rendition is served on a brioche bun with thicker pickles and a choice of either classic or spicy mayonnaise. It sells for $3.99 individually, or $6.99 if bundled as a meal with a side dish and medium beverage.

The product is to tested in central Florida for 26 days through June 21. If successfully received, it will be positioned to compete against popular chicken fillet sandwiches offered by Chick-fil-A, Popeyes and other quick service restaurants.

“We wanted a chicken sandwich that really lives up to our legacy as the fried chicken experts and, let’s face it, ours [the current menu offering] wasn’t the one to beat,” said Andrea Zahumensky, KFC’s chief marketing officer in the United States. “We knew an upgrade was necessary, so we painstakingly selected each ingredient to create a bigger, better and more premium sandwich than ever. I think we’ve unlocked a chicken sandwich that won’t just compete – it’ll win with fried chicken lovers everywhere.”

Louisville, Kentucky-headquartered KFC, a unit of Yum! Brands, is providing “first taste” samples of the new product to essential frontline workers recently honored by the Orlando Sentinel newspaper. Included in the salute are nurses, police officers, bus drivers, grocery store clerks, mail carriers, auto mechanics and teachers.

Mixed Bag of Q1 Results

Meanwhile, KFC has reported a 2% decline in global sales for the first quarter ending on March 31, 2020. Other results logged by its Yum! Brands parent company, which were down by 3% in aggregate, included a 4% gain for Taco Bell and 9% decline in revenues for Pizza Hut.

“First-quarter results reflect two different realities,” said CEO David Gibbs. “We began the year with momentum across many of our businesses, however as the quarter progressed we were heavily impacted by the unfortunate spread of Covid-19. Around the world, we took extraordinary measures to protect the health and safety of our employees, customers, franchisees and restaurant team members. We partnered with our franchise operators on our shared mission during this global crisis to provide affordable, convenient food in a safe, low contact environment with drive-thru, curbside carryout, and contactless delivery all enabled by our digital capability. As a result, our restaurants remain largely open for business, serving customers and supporting frontline workers and other essential workers in our communities. “

The chief executive officer continued: “I’m tremendously proud of all those executing across our company and franchise system, and am encouraged by the second-quarter sales trends of many of our businesses in Asia and in the United States. Over the previous three years, we transformed Yum! to be a stronger company for its stakeholders and believe we are well positioned to weather this unprecedented crisis owing to the strength of our system-wide talent, operating capabilities, global best practices, and our healthy balance sheet and liquidity position.”

Restaurant Industry Especially Hard-hit

As the world attempts to recover from the wounds of self-inflicted economic recessions – if not depressions – imposed by governments to curb the spread of Covid-19, we are all too aware that those in the foodservice sector are paying an especially high price during the lockdown. Indeed, the restaurant industry in the USA has lost more than three decades of jobs in the last two months, according to analysis of data released by the nation’s Bureau of Labor Statistics.

Eating and drinking places, which the Washington, DC-headquartered National Restaurant Association points out are the backbone and primary component of the total foodservice industry, lost 5.5 million jobs in April on a seasonally-adjusted basis. That followed a net decline of nearly a half-million positions in March, and amounts to nearly three times more jobs than any other industry in the United States.

“Just three months ago, there were more than 12 million people on the payrolls of eating and drinking places across this country, but today more than six million restaurant workers are home without a job – and that number is going to grow,” said Sean Kennedy, executive vice president of Public Affairs for the association, as he called for Congress to provide targeted relief for the restaurant industry and its employees.

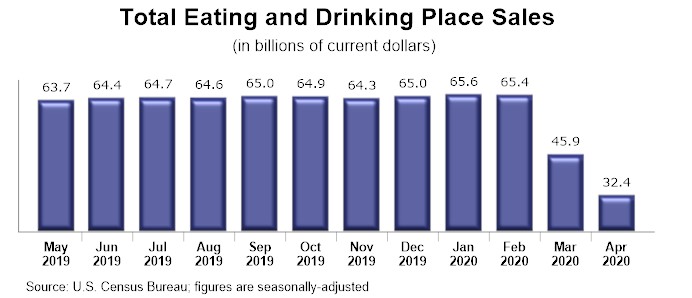

According to preliminary data from the US Census Bureau, sales rung up at eating and drinking places totaled $32.4 billion on a seasonally-adjusted basis in April. This equates to less than half – or $33 billion – of the $65.4 billion in sales that were generated two months earlier.

Is the Worst Over in the US?

Meanwhile, there are signs that the economic downturn may soon be bottoming out, as consumer confidence in the United States has reportedly improved a bit this month despite record unemployment at levels not seen since the Great Depression in the 1930s.

Noting a slowing pace of decline in manufacturing in Texas and in the services industries of the mid-Atlantic states, Chris Rupkey, chief economist at MUFG Union Bank in New York, commented: “The worst may be over for the economy. We still can’t see a V-shaped recovery, but at least this is looking like the shortest recession in history, which will be measured in months not years.”

White House Economic Adviser Larry Kudlow is not only forecasting “positive developments” for a very strong” second half of 2020, but speculating that Q3 “could be the fastest-growing quarter in US history.”

He continued: “I think we’re in a turning zone phase. The second quarter is going to be a rough quarter. It’s a pandemic contraction, a lot of hardship on the unemployment claims – a lot of heartbreak there. But these signs, and I think the market is rallying on these signs, are showing a lot more glimmers of hope and growth.”

Let’s hope both Mr. Kudlow and Mr. Rupkey are right.