Consumers’ increasingly busy lives and desire for convenience has driven demand in the ready meals sector in Britain. Revenue generated in the ready-to-eat meals market will amount to £12.45 billion in 2024, according to Statista, with sales expected to increase at a compound annual growth rate of 1.08% through 2029.

The wide range of ready meal options that cater to a variety of dietary preferences, including vegan, gluten-free and low calorie, has further fueled this growth. In fact, ReportLinker’s Ready Meal Market Overview Oct 2024 report predicts that the ready meal category in the United Kingdom is “poised for a period of robust expansion, driven by diverse contributory market segments.”

Statista’s data supports this prediction, anticipating that volume will amount to 1.21 billion kg by 2029. The ready-to-eat meals market is expected to generate growth of 0.7% in 2025, with the average per capita consumption of such products weighing in 17.1kg in 2024.

Health-Conscious Eating

A significant growth driver within the ready meals sector is increased demand for healthy and organic food options, which has led producers to focus on nutritious, balanced meals. This can be attributed to awareness of the risks associated with ultra-processed foods. As a result, ready meal makers have been tasked with easing consumer concerns by offering healthier options.

Mintel reports that shoppers want healthy ingredients clearly visible on ready meals labeling, as almost 44% of Brits and two-thirds of Americans believe that ready meals are not healthy enough for regular consumption.

“To stay competitive, food providers must offer transparent, health-focused options that cater to the specific dietary needs of their customers. Personalization, such as customizable meals, can enhance consumer satisfaction and loyalty,” according to LUPA Foods’ Five Trends in the UK Market Report.

The success of Weight Watchers and Slimming World products in the frozen ready meals sector opened the category for private label options to take a share of the market.

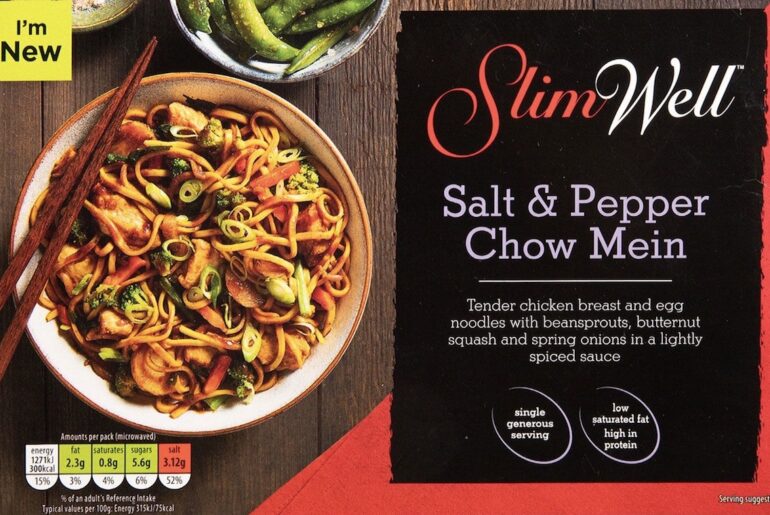

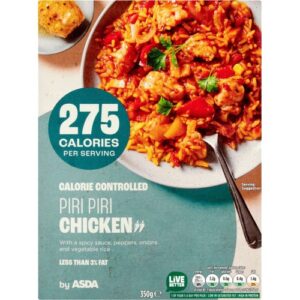

All the major supermarkets in Britain offer low calorie options under their private label brands. ASDA’s frozen Calorie Counted line includes Piri Piri Chicken (275 kilojoules) and Spaghetti Bolognese (271 calories), both costing £1.85. Tesco’s Calorie Controlled refrigerated range features Chicken Tikka Masala with rice (360 Kcal) and Mushroom Risotto (314 Kcal) priced at £3.30. Aldi’s Slim Well range costs £2.69 per dish, with options such as Salt and Pepper Chow Mein (300 kcal) that is pictured above, and Penne Arrabbiata (488 Kcal).

Demand for Sustainable Options

Today’s consumers are increasingly environmentally conscious, which extends beyond the food they eat to packaging. As a result, the food industry has moved towards more sustainable packaging solutions, with recyclable, compostable and reduced plastic options increasingly evident in the production of ready meals.

Commitment to sustainable practices is also likely to lead to repeat purchases, according to analysis from Borehamwood, Hertfordshire-based Lupa Foods, with businesses that emphasize local sourcing and sustainable practices likely to see greater customer loyalty. Factors like packaging innovations and the use of advanced preservation techniques are enhancing product shelf life and appeal, supporting market expansion.

“With energy costs being prohibitive, we have moved to passive methods instead of mechanical for the initial cooling period for our products,” said Daniel Gibson, director of Harvest Foods. “We have developed a wind tunnel, using air flow, to take the initial high temperatures out of the food before placing them in a freezer.”

He continued: “The carbon footprint savings and financial savings are considerable as when the food is at its hottest it’s the most intense period for the mechanical cooling to contend with and puts the most strain on our freezer units. We have estimated around 20% saving.”

The frozen ready meals formal can also help to reduce environmental impact by reducing food waste. For example, bagged frozen ready meals allow for easier portion control and therefore minimize waste.

Discount retailer Aldi’s Thai Green Curry Rice Meal (£2.39), for example, which includes rice, green Thai sauce, vegetables and chicken, comes in a handy bag, so consumers can use as little or as much as they like.

Ready Meal Trends

Although UK consumers are keen to try world cuisines, traditional and Italian frozen ready meals make up around 40% of the market. However, Indian and Chinese-style options are also particularly popular options, according to Nielsen.

A major trend in the sector is luxury meals and restaurant-grade food options, which have been driven by the cost of living crisis in Britain as consumers seek lower cost alternatives to dining out, often referred to as fakeaways.

“In contrast to the premium products trend, the other area of growth is in basic, cost-saving meals, such as Just Essentials from ASDA, offering meals for £1,” said Rupert Ashby, chief executive of the British Frozen Food Federation. “That is phenomenal value in today’s economic crisis and shoppers are rewarding this segment for providing this solution.”

ASDA’s Essentials range of frozen ready meals includes Spaghetti Bolognese and Chicken Curry and Rice, both of which have a four-star rating out of a possible five stars.

“Fusion is the latest trend we have seen – Combining Italian products like pasta with Indian sauces, for example,” said Harvest Foods’ Gibson. “Plant-based continues to be a big trend, with mushroom or pea-based protein products going into dishes such as a lasagne, instead of beef mince. This is a small percentage of what we do, but something we see potential in and we are working with suppliers to begin manufacturing.”

The UK food market going into 2025 is characterized by a strong focus on sustainability, health, convenience, and experiential dining. According to analysis from LUPA Foods: “As consumer preferences continue to evolve, businesses that adapt to these trends by offering high quality, personalized, and environmentally conscious products will be well positioned for success.”

The high demand for quality ready meals has driven innovation and value within the frozen meals sector. It is clear that own labels have risen to the challenge, with the introduction of a variety of options at a range of affordable price points, making ready meals more accessible to all.