Reporting quarterly sales results on August 27, Greenyard says that financial recovery is “progressing well” due to rigorous implementation of a transformation plan “with a strong focus on margin and profitable volumes and rightsizing the overhead cost base.”

The Sint-Katelijne-Waver, Belgium-headquartered vegetable and fruit specialist expects the impact of carefully laid plans to accelerate in the second half of the year.

The company anticipates that 1H year Adjusted EBITDA will land in the range of EUR 43.0-45.0 million (before application of IFRS 16), marking a sharp recovery versus the previous half year (EUR 23.3 million).

Sales by Segment

In anticipation of the full effect of newly signed partnership volumes (Carrefour, Delhaize, Tesco), Greenyard’s net sales for Q1 came in at EUR 1,031.3 million, or EUR 28.0 million (-2.6%) below last year’s EUR 1,059.4 million figure for the same quarter.

- Fresh sales decreased by 4.0% from EUR 884.7 million to EUR 849.4 million, equally due to the termination of certain loss-making sales activities such as the exceptional shortage of avocado volumes, and price pressure on categories including grapes, melons and citrus. This effect has not yet been fully offset by volumes for the partnerships that are ramping up.

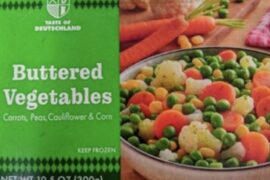

- Long Fresh sales, which includes Pinguin brand frozen products, increased 4.1% versus last year, from EUR 174.7 million to EUR 181.9 million, thanks to significant growth in the foodservice and industrial customer segments.

![]()