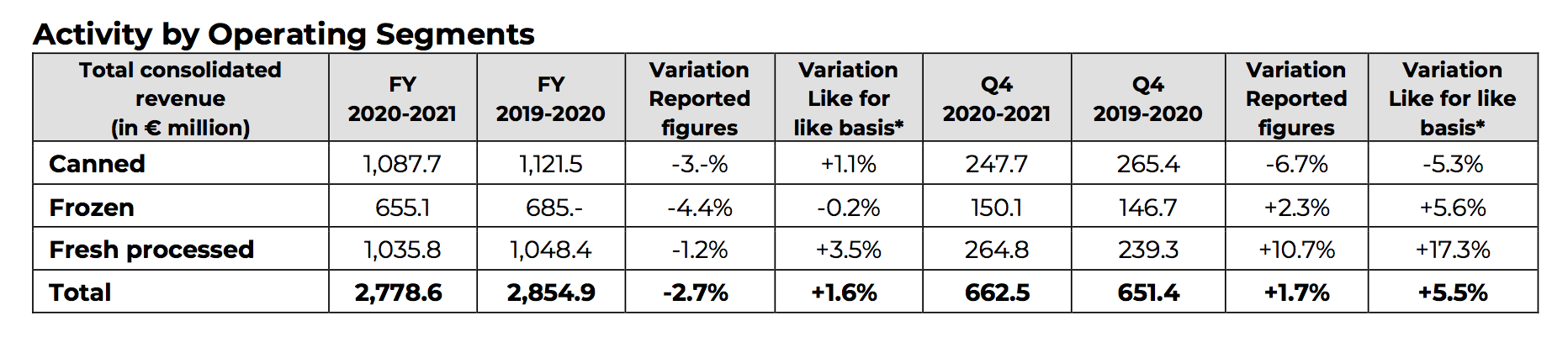

The Bonduelle Group’s sales of frozen vegetable products during the 2020-21 financial year (FY) ending on June 30 amounted to €655.1 million, while fourth quarter turnover of €150.1 million was up +5.6% on a like-for-like basis.

Total revenue for all operating segments – canned (€1,087.7 million), fresh processed (€1,035.8) and frozen was €2,778.6 million, which was in line with initial growth objectives on a like-for-like basis despite negative effects of the continuing coronavirus (SARS-CoV-2) health crisis during the entire financial year and product shortages related to the challenging summer 2020 crop season.

In a consumer environment far different from the one in which the annual targets were set, the Renescure, France-headquartered company reports that it “has demonstrated extreme resilience thanks to a portfolio of diversified business activities in terms of technologies, distribution channels and geographical areas.”

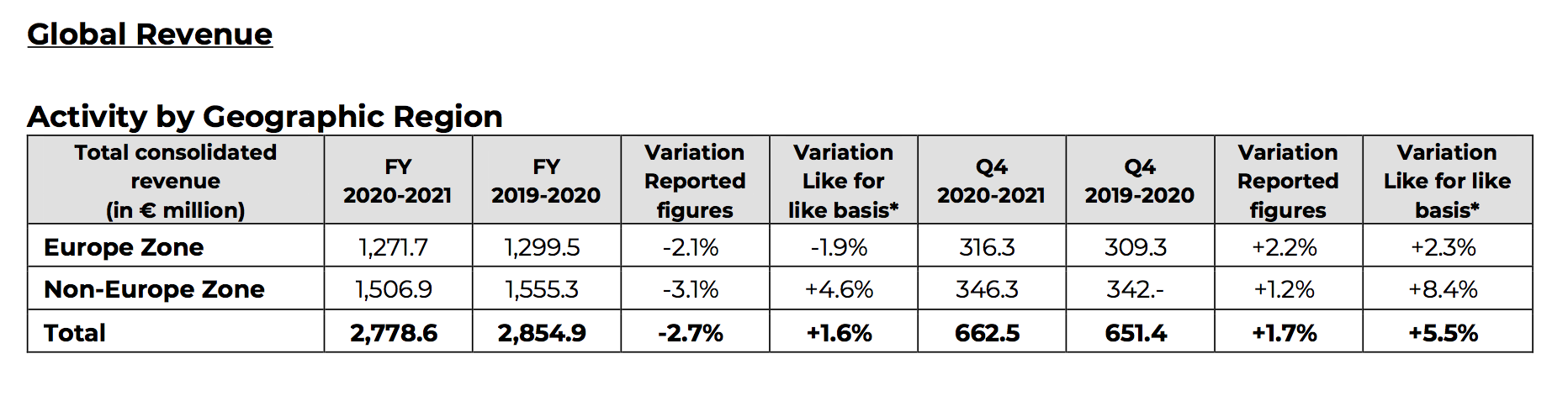

At €2,778.6 million, Bonduelle’s turnover for the financial year was up +1.6% on a like-for-like basis and down -2.7% on reported figures. Currency fluctuations had a particularly unfavorable effect on the result, reducing growth by nearly -4.3% (mainly due to the weakening of the US dollar, Russian rouble and Canadian dollar).

As expected, Q4 saw an increase of +1.7% on reported figures, but more importantly a +5.5% performance on a like-for-like basis, helped by favorable comparison bases, reflecting the recovery of the foodservice business, while activity in the retail sector remained solid.

Europe Zone

Receipts generated in the Europe Zone, representing 45.8% of total turnover, declined -2.1% on reported figures and -1.9% on a like-for-like basis.

On the retail front, the relative stability of revenue was mainly due to unfavorable comparison bases (precautionary purchases in Q3 and Q4 of 2019-20) and product shortages resulting from the poor agricultural campaigns lat summer. These factors mask the remarkable growth in sales of the Bonduelle brand in frozen food segment and the Cassegrain brand in canned food, according to the company.

The fresh ready-to-eat segment continued to be heavily penalized by limited sales in retail stores over a large part of the year, affecting the entire market. The coronavirus pandemic and its effects on foodservice business activity once again had a major impact on the frozen and ready-to-eat fresh segments over a large part of the year. Q4 recorded, with the gradual lifting of coronavirus-related social and traffic restrictions, a significant increase in both sectors.

Non-Europe Zone

Sales in the Non-Europe Zone represented 54.2% of the business activity over 2020-21 fiscal year, up +4.6% on a like-for-like basis and down -3.1% on reported figures.

In North America, the fresh ready-to-eat business posted solid growth over the financial year, helped by a favorable comparison base and the gradual reopening of restaurants in Q3. However, the sales mix, linked to the coronavirus pandemic, coupled with the significant operational difficulties mainly related to labor shortages and inflationary pressure, continued to weigh significantly on profitability.

The long shelf life product segment in North America (frozen and canned items), as in Europe, recorded contrasting activity between distribution networks, which nonetheless allowed the business to remain stable over the financial year.

Frozen and canned product sales in Russia and Eastern Europe realized solid growth during the year despite a depressed consumer environment. The positive performance was thanks to the resilience of the Bonduelle brand and the growth of the Globus label in the canned segment, as well as strong development in the frozen sector related to the successful launch of locally produced offerings.

Outlook

Given the evolution of business activity and despite the impact on profitability from the coronavirus pandemic that affected the entire 2020-21 financial year, the current operating profitability of the group should stand at circa 3.6% of the turnover in line with Bonduelle’s published objective.