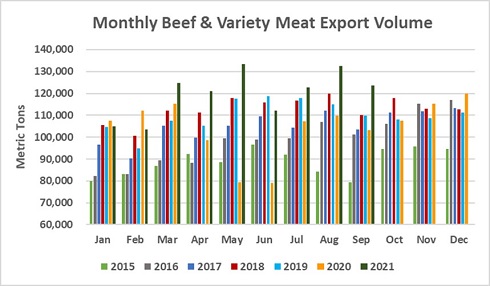

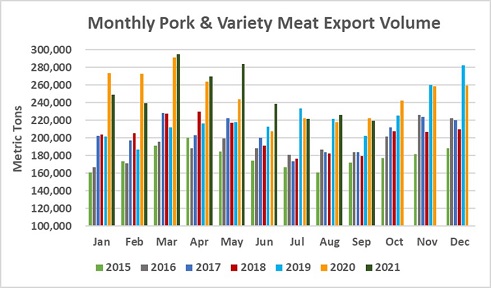

Both beef and pork exports from the United States were on a record pace through September, according to data released by USDA and compiled by the Denver, Colorado-based US Meat Export Federation (USMEF). Beef shipments posted one of the best months on record in September, with value climbing nearly 60% above last year. Pork export volume was slightly below last September, but value still increased 8%.

Beef shipments to destinations outside the United States continued to soar in September at 123,628 metric tons (mt), up 20% from a year ago and the fourth largest volume of the post-BSE era. Export value jumped 59% to $954.1 million – the second highest month on record, trailing only August 2021. For the first three quarters of 2021, beef exports increased 18% from a year ago to 1.08 million mt, valued at $7.58 billion – up more than $2 billion (36%) from the same period last year. Compared to the record year of 2018, January-September exports were 7% higher in volume and up 24% in value.

Pork exports totaled 219,687 mt in September, down 1% from a year ago, but value was 8% higher at $608.3 million. For January through September, exports were 1% above last year’s record pace at 2.24 million mt, while value climbed 9% to $6.23 billion.

“Facing significant logistical headwinds and higher costs, these outstanding results are really a testament to the loyalty and strong demand from our international customers and to the innovation and determination of the US industry,” said USMEF President and CEO Dan Halstrom.

Variety Meat Exports Bright Spot in 2021

Halstrom explained that a rebound in pork and beef variety meat exports, which took a step back last year amid coronavirus pandemic-related production obstacles, has been a strong source of momentum in 2021, reflecting exceptional global demand for high-value protein.

“The increase in the variety meat capture rate, and the resulting increase in exports, is especially encouraging because the labor and transportation challenges certainly have not gone away,” Halstrom said. “But these items are commanding a strong premium overseas, making it more feasible to get them into international commerce. Variety meat exports are a great complement to our strong domestic and international demand for muscle cuts, helping maximize carcass value.”

China’s demand for US pork variety meat has remained strong even as muscle cut exports to China have eased, helping push total January-September pork variety meat exports 17% above last year to 405,744 mt, valued at $949.1 million (up 26%). Beef variety meat exports, led by strong increases in Japan, Mexico, Central and South America and the ASEAN region, were 10% above last year at 226,755 mt, with value up 19% to $762.2 million.

Beef Exports to Top $2 Billion in Three Asian Markets

Beef sales to leading import market Japan posted a strong performance in September at just under 30,000 mt, up 24% from a year ago, valued at $215.8 million (+73%). This pushed January-September results 5% above last year at 246,380 mt, valued at $1.72 billion (up 17%).

Japan, South Korea and China/Hong Kong are all on track to be $2 billion destinations for US beef in 2021, with strong growth in chilled beef exports to Japan and Korea. Through September, chilled beef exports to Japan neared 120,000 mt, up 17%, with value up 25% to $1 billion. Chilled exports to Korea were up 25% in volume (65,600 mt) and 50% in value ($744 million).

Total September beef exports to Korea were 23,363 mt, up 9% from a year ago, while value soared 67% to $207.5 million. Through the third quarter, shipments to Korea climbed 12% in volume (213,326 mt) and 30% in value ($1.71 billion). Covid-related restrictions on restaurants and other foodservice outlets were recently eased in both Japan and Korea, which should provide further momentum for US exports.

China has been a major source of growth for US beef sales in 2021, with exports through September climbing 672% from a year ago to 138,041 mt, while value was up 761% to $1.12 billion. Combined shipments to China and Hong Kong were up 131% through September at 176,694 mt, valued at $1.49 billion – already shattering the previous value record of $1.15 billion set in 2014.

Other January-September highlights for beef exports from the United States include:

•Demand in Mexico continued to rebound from last year’s low totals. Exports through September reached 147,719 mt, up 17% year-over-year, while value climbed 40% to $768 million, but these results were still below the pre-Covid levels attained in 2019.

•Taiwan has been another big growth market for chilled US beef, with volume up 22% to 24,366 mt and value reaching $313 million (+36%). Beef purchased from United States producers accounts for more than 80% of Taiwan’s chilled imports. Total US beef exports to Taiwan were up 14% in value to $472.7 million, although volume slipped 3% to 47,000 mt.

•Led by a strong increase in Indonesia and larger shipments to the Philippines, beef exports to the ASEAN region climbed 23% from a year ago to 43,567 mt, while value was up 30% to $223.8 million.

•A strong rebound in Colombia and increased demand in Chile and Peru pushed exports to South America 24% higher than a year ago at 22,265 mt, valued at $118.4 million (+71%). Peru is a top destination for US beef variety meat exports, with January-September volume totaling 6,625 mt – up 2% from last year’s strong level and the fastest pace since 2014.

•Strong retail demand in several markets, notably Guatemala (5,712 mt, up 50%) and Costa Rica (3,375 mt, up 96%), helped put beef exports to Central America on a record pace at 14,896 mt, up 61% from a year ago, while value soared 89% to $91.5 million.

•September beef export value equated to $447.46 per head of fed slaughter, up 63% from a year ago. For the first three quarters of the year, export value averaged $389.08 per head (+32%). Exports accounted for 15.7% of total September beef production and 13% for muscle cuts, up substantially from last year’s ratios of 12.8% and 10.5%, respectively. Through September, exports accounted for 15.1% of total beef production and 12.8% for muscle cuts, each up nearly two full percentage points from a year ago.

Western Hemisphere Pork Export Growth Offsets Softer China Demand

Strong demand from Mexico provided another powerful boost for pork exports from the United States in September. Shipments climbed 45% from a year ago to 79,678 mt, the third highest volume on record, valued at $141.6 million (up 59%). Through September, exports to Mexico were up 27% to 623,228 mt, while value climbed an impressive 57% to $1.24 billion. Exports have also moved ahead of the record pace of 2017, when full-year shipments to Mexico topped 800,000 mt and exceeded $1.5 billion in value.

Pork exports to Central America continued to shine in September, climbing 63% from a year ago to 11,110 mt, while value nearly doubled to $30.9 million (up 93%). Led by outstanding growth in Guatemala, Honduras, El Salvador, Costa Rica and Nicaragua, January-September exports to the region increased 48% in volume (98,547 mt) and 63% in value ($263.1 million).

Following a down year in 2020, pork shipments to Colombia have staged an impressive comeback. September exports totaled 7,934 mt, up 68% from a year ago, while value more than doubled to $20.5 million (+103%). Through the first three quarters of the year, purchases by buyers in Colombia nearly matched the pre-Covid levels of 2019 in volume (70,905 mt, up 55% from a year ago) and actually moved higher in value at $169.5 million (up 70% from a year ago and 7% above 2019).

Other January-September highlights for US pork exports include:

•As anticipated, total pork shipments to the China/Hong Kong market declined significantly from a year ago, falling 23% to 619,709 mt. However, pork variety meat sales have strengthened, increasing 24% to 259,703 mt and climbing 29% in value to $623.7 million. Variety meat exports to China averaged nearly six pounds per head harvested through September, valued at $6.52.

•Although September export volume to Japan was down 5% from a year ago to 29,102 mt, export value still increased slightly to $128.4 million. Through September, exports to Japan were 6% above last year at 300,982 mt and climbed 7% in value to $1.28 billion.

•Pork exports to Korea were 5% above last year at 128,467 mt, while export value jumped 20% to $419 million, driven in part by a surge in Korea’s demand for higher-value US chilled pork. Korean customs clearance data show chilled imports from the US reached nearly 7,500 mt through September, up 177% year-over-year, capturing 40% market share and narrowly edging Canada as the top supplier.

•Demand for US pork continues to climb in the Dominican Republic, where exports increased 45% to 42,440 mt, valued at $109 million (up 66%).

•September pork export value equated to $56.53 per head slaughtered, up 11% from a year ago. Through September, per-head export value was also up 11% to $65.06. Exports accounted for 26.9% of total September pork production, up slightly from a year ago, while the ratio of muscle cuts exported was down about one percentage point to 23.1%. Through September, exports accounted for 30.4% of total pork production, up from 29.6% a year ago. The ratio of muscle cuts exported was 26.8% (down slightly).

September Lamb Exports Above Last Year

While September exports of US lamb were up only slightly from a year ago at 948 mt, value climbed 39% to $1.6 million as growth was driven primarily by a sharp increase in muscle cut shipments to the Dominican Republic. Through September, lamb product sales rose 5% to 9,945 mt, valued at just under $14 million (+11%). Shipments increased to leading market Mexico and trended higher to the Dominican Republic, Bermuda, Guatemala and Honduras.