Retail sales at Aldi UK rose 8% and Lidl GB posted a 12% gain in the four-week period ending on Christmas Eve to surpass £1.5 billion, according a January 2 Reuters dispatch. It added: “Both chains said they recorded their busiest ever day of trading on Friday, December 22, with more than 2.5 million customers coming through Aldi’s doors on the day.”

Take-home grocery sales in the United Kingdom were expected to have surpassed £13 billion for the first time ever in December, according to Kantar, the London, England-headquartered data analytics and brand consulting company. Recent figures showed that receipts increased by 6.3% over the four-weeks period through November 2023 to reach £11.7 billion.

Britain’s two largest supermarket operators continued their fightback in the battle for market share in November, at a time when the rate of price inflation dipped to 9.1% from 10.1% the previous month.

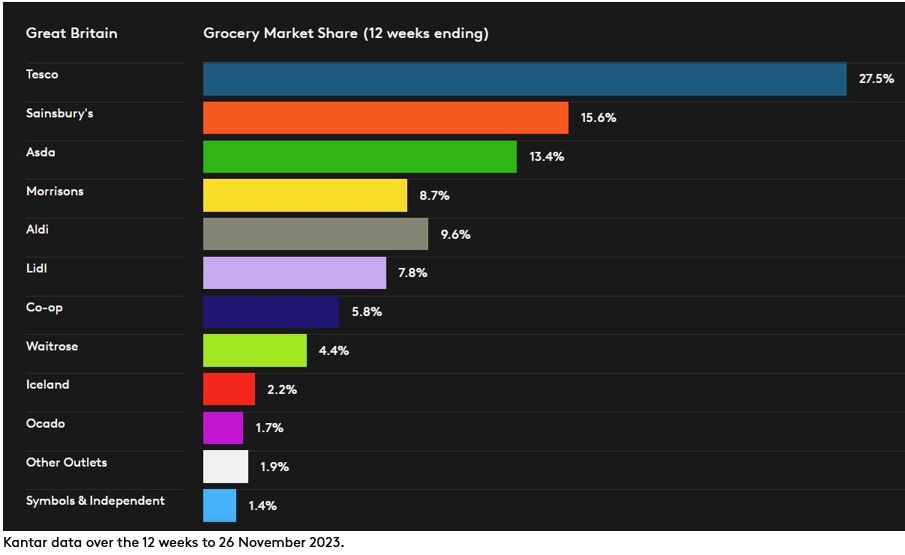

“Sainsbury’s delivered its largest market share gain in over a decade, taking an additional 0.4 percentage points to reach 15.6%,” reported Fraser McKevitt, head of retail and consumer insight at Kantar’s UK Worldpanel Division. “The last time it made this big a jump was in March 2013. Growth was driven in no small part by the continued success of its own label offer, with sales of its popular ‘Taste the Difference’ range up by a whopping 23% year on year.”

Tesco also put in a strong performance to increase its market share to 27.5% following a growth in sales of 8.6%, marking the fifth month in a row that Britain’s largest retailer has made gains.

“Lidl is again the fastest growing grocer, boosting sales by 14.1% over the 12 weeks to 26 November to take a record high share of 7.8%,” added McKevitt. “Aldi increased sales by 11.1% and now holds 9.6% of the market. Sales at Asda and Morrisons were up by 2.6% and 3.7%, respectively. They now have 13.4% and 8.7% of the market each. Co-op’s share stands at 5.8%, while Waitrose accounts for 4.4% of the market. Frozen specialist Iceland saw an increase in sales of 3%. Growing ahead of the market, Ocado’s sales jumped by 12.1%, holding its market share steady at 1.7%.”

Retailers put the emphasis on private label ranges and promotions to attract shoppers. Kantar data shows that spending on offers hit its highest level in over two years in the latest period at 28.4%.

“We’re well above 2022 levels, with customers making an additional £180 million in savings this November versus 12 months ago,” said McKevitt. “Brands have benefited from the boost in offers and have now edged ahead of their own label counterparts, growing sales by 6.5% versus 6.4% for retailer lines. However, own-label is still doing incredibly well and premium lines especially so. These products are up by 15.4% year on year.”