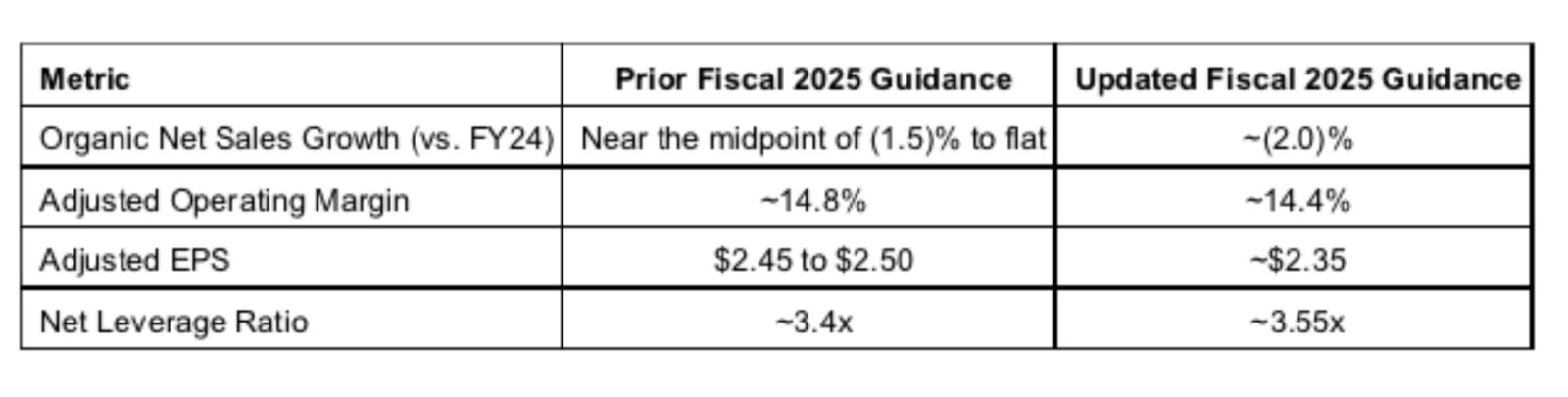

Having experienced customer service interruptions during the third quarter due to supply constraints on frozen meals containing chicken and frozen vegetables, coupled with the expectation that foreign exchange headwinds will further impact earnings per share, Conagra Bands has updated its fiscal 2025 financial outlook, as detailed below:

The company’s forecast for capital expenditures, free cash flow conversion, interest expense, Ardent Mills’ contribution, pension income, adjusted effective tax rate and inflation remain unchanged from its second quarter earnings materials. While updated guidance does not include any potential impacts from new tariffs, long-term financial targets are unchanged.

The company’s forecast for capital expenditures, free cash flow conversion, interest expense, Ardent Mills’ contribution, pension income, adjusted effective tax rate and inflation remain unchanged from its second quarter earnings materials. While updated guidance does not include any potential impacts from new tariffs, long-term financial targets are unchanged.

Addressing the Consumer Group of New York (CAGNY) Conference on February 18, CEO Sean Connolly commented: “We are committed to investing behind our brands and innovation, and delivering the high-quality products our customers expect. We are pleased with the strong and consistently improving demand that has been experienced this year as a result of those investments. While we’ve faced recent challenges servicing that demand, our investments in infrastructure and strategic partnerships position us for long-term success.”

Frozen Meals Containing Chicken

In the third quarter, the company has experienced manufacturing challenges at the primary facility that prepares and cooks chicken used in frozen meals. Upon seeing product quality inconsistencies coming off the production lines, corrective action was promptly taken. This included temporarily halting production, implementing operational adjustments, and restarting at a slower pace to restore consistency.

Conagra also engaged with third-party manufacturers. While these actions enabled the company to resume production that met its strict quality standards, the net impact of this issue is lower volume, net sales, and profit in the second half of the fiscal year.

Conagra also engaged with third-party manufacturers. While these actions enabled the company to resume production that met its strict quality standards, the net impact of this issue is lower volume, net sales, and profit in the second half of the fiscal year.

Conagra had previously planned to implement substantial modernizing upgrades to this summer. That work remains on track, with targeted completion by the end of the first quarter of fiscal 2026. To ensure supply during this period, work with third-party manufacturers is ongoing to build up inventory ahead of the planned upgrades. In the short term, the plant will maintain operations at a reduced pace.

Frozen Vegetables

Building on strong second quarter performance, consumption growth rates in Conagra’s frozen vegetable business, which includes Birds Eye brand products, nearly doubled through December and early January versus the year-ago period. The higher-than-anticipated demand depleted inventory on hand and led to out-of-stocks in stores. In turn, the company put customers on a strict product allocation and reduced merchandising from January through March 2025 in an effort to rebuild inventories ahead of the Easter holiday. The net effect is lost volume, primarily in the third quarter of fiscal 2025.

Given the strong consumer response to Conagra’s investments in its frozen vegetables business in fiscal 2025, the company has invested in increased surge capacity moving forward to accommodate the sustained growth in demand.

Ranked as one of North America’s leading branded food companies, Conagra’s fiscal 2024 net sales exceeded $12 billion. In addition to Birds Eye, its portfolio of frozen product brands includes Healthy Choice, Marie Callender’s, Banquet, Hungry-Man, Alexia, Celeste, Mrs. Paul’s, Van de Kamp’s, Frontera and gardein.