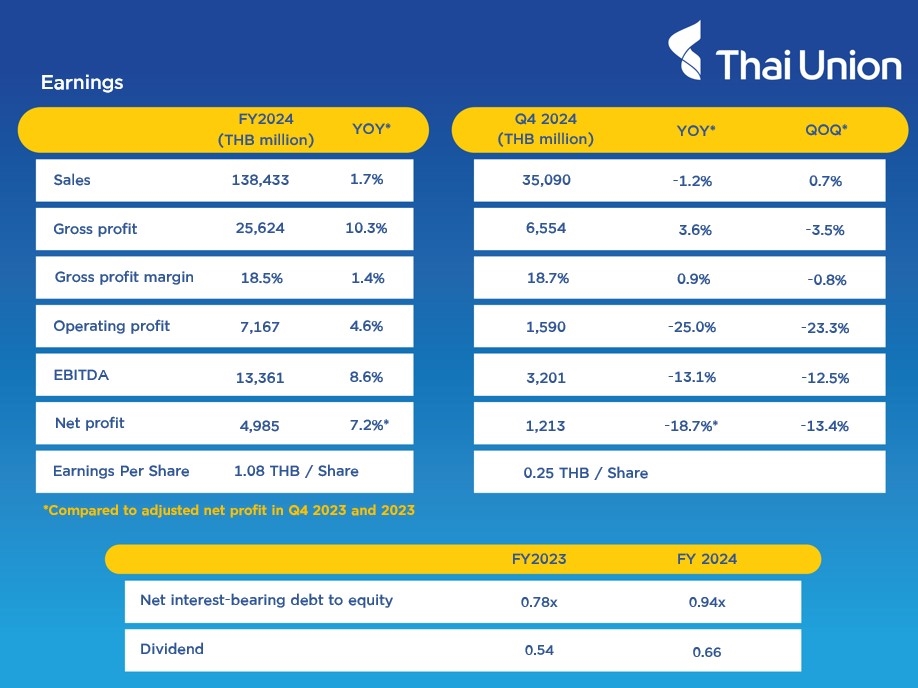

The Bangkok-headquartered Thai Union Group has reported full-year 2024 sales of THB 138.4 billion. Net profit increased 7.2% year-on-year to THB 5.0 billion, with earnings per share of THB 1.08, growing by 10.4%. With this, the seafood company delivered a second half-year dividend of THB 0.35 per share, bringing the full-year dividend to THB 0.66 per share, representing a payout ratio of 60% and a dividend yield of 5.7%.

Sales showed positive momentum throughout the year, growing 1.7% from a year earlier. The Group booked a gross profit margin of 18.5%, with the highest proportion coming from gross profit margin (GPM) in the ambient products segment (which accounted for 49% of generated revenue), supported by an improved GPM for frozen seafood (31% of total sales) following the strategic decision to remove low margin products, and all-time high GPM in the pet care segment.

In 2024, Thai Union launched Strategy 2030, an ambitious plan to drive significant growth and achieve its vision of becoming the world’s leading marine health and nutrition company. Two key transformation initiatives that will support the broader goals of the strategy were launched: Project Sonar, which will address critical enablers for Strategy 2030, and Project Tailwind, which focuses on accelerating growth of pet food. As a result, the Group incurred significant transformation costs. Excluding those costs, net profit in 2024 increased by 22.3% year-on-year to THB 5.7 billion.

Thai Union demonstrated strong improvement in profitability ratios and continued to maintain a strong balance sheet, with net-debt-to-equity ratio remaining healthy at 0.94x. The Group also generated all-time high free cash flow of THB 11.7 billion due to a healthy EBITDA, which increased 8.6% year-on-year to THB 13.4 billion – the second highest on record – as well as efficient inventory management. These enhanced the Group’s financial flexibility for future investment opportunities.

Q4 Sales Down 1.2%

For the fourth quarter of 2024, sales declined 1.2% year-on-year due to an unfavorable foreign exchange impact of 3.1%, offsetting organic sales growth of 1.9% year-on-year for two consecutive quarters. The gross profit margin stood at 18.7%, reflecting the company’s solid recovery. Net profit in the fourth quarter declined 18.7% year-on-year to THB1.2 billion because of higher costs related to Strategy 2030 programs. Excluding transformation costs, net profit grew 1.3% year-on-year to THB 1.5 billion.

“Ambient, pet care and value-added businesses demonstrated remarkable resilience in the face of weak global economic growth and more cautious spending among consumers around the world,” said CEO Thiraphong Chansiri. “As we continue to execute our Strategy 2030, I am optimistic that Thai Union will be positioned for long-term, sustainable growth as we pursue an ambitious goal of boosting net sales to US $7.0 billion and doubling EBITDA by 2030.”

Strong demand for Thai Union’s products continued last year. A decline in raw material costs along with healthy sales volumes helped deliver a gross profit margin of 19.1% in the ambient sector. Pet food sales rose 15.5% year-on-year to THB 17.4 billion due to an increase in its premium product mix and higher sales volumes in Europe and China.

Frozen Product Sales Fall 10.7%

Despite the decrease in frozen product sales of 10.7% to THB 42.2 billion from a year earlier following weaker demand and business rightsizing in the United States, Frozen GPM continued to improve as expected, reaching 11.7%. Sales in value-added products increased 5.2% year-on-year to THB 10.4 billion.

In terms of geographical diversity, 2024 sales in the USA and Canada accounted for 39.4% of total revenue generated, followed by 30% from Europe, 11% percent from Thailand, and other regions at 19.6%.

In December 2024, Thai Union announced its fourth share repurchase program, in order to reward shareholders by returning excess capital to them and boost earnings per share. The program will not exceed THB 3.0 billion or 200 million shares to be bought between January 2 and June 30. As of February 14, 2025, the total cumulative number of shares repurchased was 107,093,500 million.

“We will continue to face new challenges in 2025, with ongoing geopolitical tensions, potential impact from changes to US trade policies, and persistent stagnant economic growth,” said CEO Thiraphong Chansirii. “But Thai Union remains ambitious, and we are building momentum to turn the tides in our favor through Strategy 2030, transforming our business and pursuing our vision to become the world’s leading marine health and nutrition company.”