Revenues generated by the Thai Union Group decreased 12.6 percent year-on-year during the second quarter of 2023 to approximately THB 34.1 billion, due to last year’s high baseline, high inventory levels among customers, logistics normalization, and overall softer demand. Net profit during the three-month period ending on June 30, 2023, slumped 36.7 percent to THB 1.029 billion, mainly because of significant foreign exchange losses and the dilution effect on the net profit of its i-Tail pet-grade ingredients unit.

However, the Samut Sakhon, Thailand-headquartered producer of frozen shrimp, shelf-stable tuna and other seafood products recorded a gross profit margin (GPM) of 16.9 percent stable from last year despite higher raw material price increases. It also delivered an operating profit of almost THB 1.8 billion, an 8.2 percent rise year-on-year. Free cash flow was solid at THB 3.3 billion, mainly driven by improvements in net working capital.

With the core performance improving, the company declared an interim dividend of THB 0.30 per share, which will be paid on September 4 to stock holders with an ex-dividend date on August 21 and record date as of August 22, 2023.

“The first half of 2023 has not been easy, but we are starting to see early signs of a recovery in various markets during the latter half of 2023. Moreover, our balance sheet is still strong, with net debt to equity ratio at 0.64 times in the second quarter, well below our target of 1.0x times. We have a healthy dividend payout rate of 70.3 percent of our net profit,” said CEO Thiraphong Chansiri.

Sales are usually higher during the second quarter due to seasonal factors, he pointed out, and this was reflected in the company’s earnings for 2Q23 with sales rising 4.3 percent quarter-on-quarter to THB 34.1 billion. Net profit increased by 0.7 percent for the period from the bottom of the first quarter. There was improved momentum during the second quarter with the gross profit growing by 16.9 percent from the previous quarter to THB 5.7 billion.

Ambient seafood business sales returned to growth in the second quarter, rising 1.3 percent year-on-year to THB 17.1 billion, posting its highest quarterly sales level in the past nine years, thanks to higher selling prices and promotional activities, especially in the EU market. The company’s branded products continue to offer new innovations, focusing on variety, diversity, health and wellness.

Meanwhile the performance of the Red Lobster foodservice chain, of which Thai Union holds a 25% ownership, improved in the second quarter as turnaround strategies continued to have a positive impact, booking a THB 94 million share of loss from operations compared to THB 281 million during the same period in 2022.

“Looking ahead to the remainder of 2023, we will reinforce our profit protection plan measures globally to improve profitability, targeting cost savings and greater cost efficiencies in all operations. Thai Union remains optimistic about the longer-term outlook and is also excited about maintaining our position as a sustainability leader in the global seafood industry,” added Chansiri.

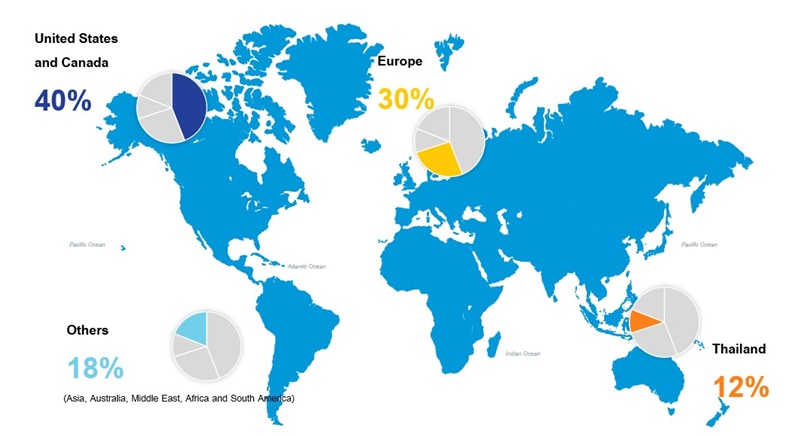

In business since 1977, Thai Union employs a global workforce of more than 44,000 people and is regarded as one of the world’s leading seafood producers and among the largest packers of shelf-stable tuna with annual sales exceeding THB 155.6 billion (US $4.4 billion). Frozen and chilled products account for 35 percent of revenues, compared with 48 percent for ambient seafood. Pet foods, value added and miscellaneous products account for the remaining 17 percent of receipts.