Grocery price inflation in the United Kingdom rose by 17.3% in the four-week period that ended on April 16, 2023, down marginally on the 17.5% recorded in the previous four weeks according to the latest data from Kantar reported by Fraser McKevitt, the head of its Worldpanel Division’s retail and consumer insight in Britain. Take home grocery sales grew by 8.1% over the month to mid-April.

“The latest drop in grocery price inflation will be welcome news for shoppers, but it’s too early to call the top,” said McKevitt. “We’ve been here before when the rate fell at the end of 2022, only for it to rise again over the first quarter of this year. We think grocery inflation will come down soon, but that’s because we’ll start to measure it against the high rates seen last year. It’s important to remember, of course, that falling grocery inflation doesn’t mean lower prices, it just means prices aren’t increasing as quickly.”

Shoppers Trade Down as Aldi Boosts Share

After ten months of double-digit price growth, the British public is continuing to turn to private label products to help manage spending. McKevitt reported that own label lines, which are often cheaper, are still growing at 13.5% this period suggesting shoppers are finding better value for money on these shelves. The very cheapest value own label lines are doing even better, with sales soaring by 46% versus a year ago. These products now find their way into nearly one in five baskets. Branded sales are going up but more slowly at 4.4%.

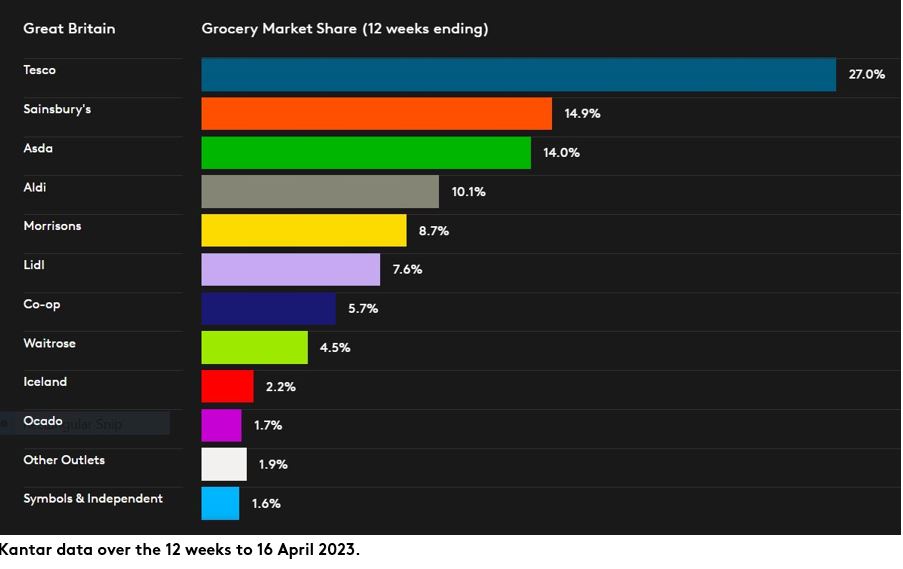

Amid rising prices, both Aldi and Lidl hit new record market shares over the latest 12-week period at 10.1% and 7.6%, respectively. Lidl was the fastest growing grocer with sales increasing by 25.1%, while Aldi is just behind at 25.0%.

“Consumers are continuing to shop around, visiting at least three major retailers every month on average. The discounters have been big beneficiaries of this, with Aldi going past a 10% market share for the first time this month. That’s up from 5% eight years ago in 2015, so we can see just how competitive the market can be,” said McKevitt. “Retailers are battling it out to show value to shoppers, but if consumers feel their offer isn’t quite right then they’ll go elsewhere.”

The three largest grocers in Britain continued to grow at similar rates in the 12 weeks to April 16. Asda led the pack with sales up 8.8% year on year, giving it a 14.0% share of the retail food market. Tesco and Sainsbury’s weren’t far behind with their sales increasing by 8.0% and 8.7%, claiming 27.0% and 14.9% of the sector respectively.

Morrisons’ receipts continued to increase, and it now holds an 8.7% share of the market. Co-op’s market share stands at 5.7%, with sales growing by 2.7% in the latest 12 weeks. Waitrose’s sales increased by 3.2%, its best performance since June 2021, pushing its market share to 4.5%. Iceland matched the 12-week market growth rate of 9.4%, maintaining its level of share at 2.2%. Ocado outpaced the overall online market, increasing sales by 8.7%.