June exports of pork from the United States fell below year-ago levels for the first time this year, but exports remain on a record pace in 2020, according to data released by USDA and compiled by the Denver, Colorado-headquartered US Meat Export Federation (USMEF). Beef exports were down sharply from a year ago in the same month, reflecting a lingering impact of a temporary slowdown in beef production combined with restrictions on foodservice and weakening economies in major import markets. June lamb exports trended higher, posting the second largest totals of 2020.

“We expected that the interruptions in red meat production would continue to weigh on June exports, but anticipated more of a rebound from the low May totals – particularly for beef,” said USMEF President and CEO Dan Halstrom. “But it takes time for the entire chain to adjust to supply shocks, and thus it was another difficult month for exports. However, weekly US export data suggest an upward trend in demand in most markets, and with production recovering the United States has regained its supply advantage. So we expect beef and pork exports to regain momentum in the second half of the year.”

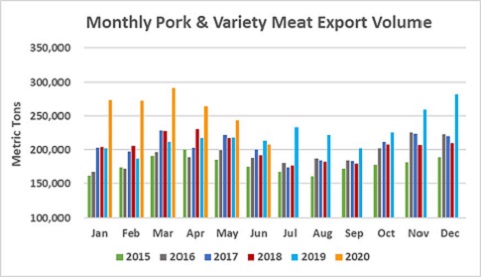

June pork exports totaled 207,181 metric tons (mt), down 3% from a year ago, while export value fell 9% to $516.3 million. Exports continued to trend higher than a year ago to China/Hong Kong, but were the lowest since October. Exports also increased year-over-year to the ASEAN region, the Caribbean, Honduras and Taiwan, and were sharply higher for Albania and Ukraine. But shipments trended lower to Mexico, Japan, South Korea and South America. Despite the June decline, first-half pork exports were still 24% ahead of last year’s record pace in volume (1.55 million mt) and 29% higher in value ($4.05 billion).

Exports accounted for 24% of total pork production in June and 22.2% of muscle cut production, down substantially from a year ago (27.8% and 24%, respectively). For the first half of the year, exports accounted for 31.5% of total pork production and 28.6% for muscle cuts, up from 25.8% and 22.4%, respectively, last year. Export value per head slaughtered averaged $46.19 in June, down 19% from a year ago and down sharply from the high levels achieved in April and May. The January-June average was $63.61 per head, up 27% from a year ago.

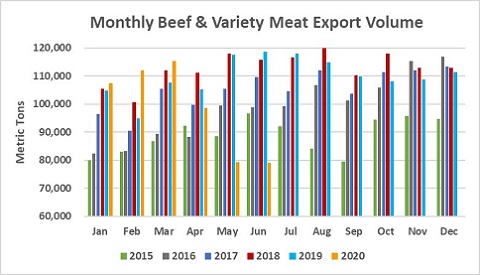

June beef exports were close to the May lows, down 33% from a year ago to 79,013 mt, with value falling 32% to $492.3 million. Exports were below year-ago levels to most markets but trended higher to Canada, China and South Africa. For January through June, beef exports fell 9% below last year’s pace in volume (591,609 mt) and 10% lower in value ($3.63 billion).

Exports accounted for 9.7% of total beef production in June and 8% for muscle cuts, down sharply from a year ago (15.4% and 12.7%, respectively) and the lowest in 10 years. First-half exports accounted for 13.3% of total beef production and 10.9% for muscle cuts, down from 14.2% and 11.6%, respectively, last year. Beef export value per head of fed slaughter averaged $219.53 in June, down 32% year-over-year. The first-half average was $300.43 per head, down 4%.

China’s Moderating Pork Demand Highlights Importance of Diversity

June pork exports to China/Hong Kong totaled 77,883 mt, up 55% from a year ago but the lowest since October. Export value was $168.3 million, up 65%. This pushed first-half exports to China/Hong Kong 170% above last year’s pace at 604,156 mt, with value up 232% to $1.42 billion.

“With China’s pork industry still dealing with the impact of African swine fever (ASF), we expect demand from China/Hong Kong to remain strong through the end of this year and into 2021,” Halstrom said. “But the unprecedented volumes of imported pork entering China – not only from the US but other suppliers as well – will begin to moderate. This underscores the importance of maintaining strong demand in other key markets and continuing to develop new destinations for US pork.”

While June pork exports to Mexico remained below last year at 48,658 mt (down 19%), valued at $70.6 million (down 41%), shipments rebounded to some degree from the low totals seen in May. First-half exports to Mexico were 6% below last year’s pace at 324,481 mt, with value down 5% to $543 million.

June exports to Japan, traditionally the leading value market for US pork, were down 25% from a year ago to 23,910 mt, valued at $109.6 million (down 17%). But through June, exports to Japan remained 1% above a year ago in volume (193,822 mt) and 5% higher in value ($813.6 million). Even as US slaughter levels rebound, limited labor availability has restricted production of value-added and boneless cuts, as well as some variety meats. This is especially challenging for serving markets such as Japan, which demands value-added cuts like single-ribbed bellies.

Other First-Half Highlights for US Pork

- Exports to Canada were steady with last year’s pace at 105,811 mt, while value increased 2% to $388.1 million.

- Led by exceptional growth in Vietnam, exports to the ASEAN region increased 13% to 28,950 mt, while value jumped 17% to $71.2 million. In Vietnam, where pork production has also been heavily impacted by ASF, exports climbed 148% from a year ago in volume (8,232 mt) and 164% in value ($18 million). Shipments to the Philippines, the top market in the region, had slowed earlier this year. But June exports were the highest since October, bringing the first-half total to 19,319 mt (down 12%) valued at $42.5 million (down 6%).

- Exports to Central America increased 2% from last year’s record pace to 45,296 mt, while value was up 5% to $112.3 million. Solid growth was achieved in mainstay market Honduras, with exports also increasing to El Salvador and trending significantly higher to Nicaragua.

- Strong growth in the Dominican Republic pushed exports to the Caribbean 4% above last year at 29,809 mt, valued at $70.6 million (up 2%). This was fueled by higher muscle cuts to the Dominican Republic and an increase in pork variety meat exports, which climbed 19% in volume (2,341 mt) and 18% in value ($3.9 million), led by the Dominican Republic, Trinidad and Tobago and Haiti.

- In Eastern Europe, pork exports to Albania (1,873 mt, up 19%; $3.8 million, up 74%), were the largest since 2012, and shipments to Ukraine (557 mt, up from just 22 mt last year; $1.35 mil, up 441%) were the largest since 2014. Exports to Macedonia reached 1,164 mt valued at $2.89 million, up from zero a year ago.

China, Canada Among Few Bright Spots for June Beef Exports

Capitalizing on the recently implemented US-China Phase One Economic and Trade Agreement, June beef exports to China climbed 125% from a year ago to 1,986 mt, valued at $15.2 million (up 111%). This pushed first-half exports to the PRC 80% above last year’s pace in both volume (6,912 mt) and value ($54.1 million).

“While Phase One was signed in January, the red meat trade provisions weren’t implemented until late March,” Halstrom noted. “That’s when beef from a larger percentage of US cattle became eligible, and more establishments were approved for export to China. So US beef exports are really just beginning to scratch the surface in the world’s largest import market. As China’s foodservice sector gradually recovers from Covid-19 restrictions and as Australia’s export volumes remain limited, the potential for growth will increase even further.”

Following a down year in 2019, first-half beef exports to Canada increased 13% to 55,099 mt, with value up 14% to $370 million. Last year exports were held back to some degree by retaliatory duties on prepared beef products, which were removed in May 2019. Canada is the largest destination for US exports in this category. Beef variety meat shipments to Canada were particularly strong in the first half, increasing 35% in volume (4,983 mt) valued at $10.5 million (up 56%).

June beef exports to leading market Japan rebounded to some degree from the low totals posted in May, but were still well below last year at 20,743 mt (down 30%) valued at $143.7 million (down 20%). First-half exports fell 2% below last year’s pace in both volume (154,881 mt) and value ($985.5) million.

Other first-half highlights for US beef exports include:

- After racing to a strong start in 2020, shipments to South Korea have fallen 8% below last year’s record pace at 116,724 mt valued at $828.3 million. US beef has a very strong retail presence in Korea, which has helped offset some of the sharp, Covid-19 related decline in foodservice demand.

- Beef exports to Taiwan were also record-large in 2019, but fell 7% below that pace at 29,101 mt, valued at $252.1 million (down 9%). The United States still dominates Taiwan’s high-value chilled beef market, capturing nearly 75% of the country’s chilled imports.

- With devaluation of the peso compounding the impact of Covid-19 restrictions in Mexico’s foodservice and hospitality sectors, beef exports to Mexico fell 24% below last year’s pace at 86,904 mt, valued at $394.6 million (down 27%). Mexico is the leading volume destination for beef variety meat exports, which have fared better in 2020, falling 3% year-over-year in volume (42,879 mt) and 10% in value ($104.9 million).

- Although June exports were down slightly year-over-year, Africa continues to emerge as a strong growth market for beef variety meat. First-half exports climbed 87% to 15,131 mt, valued at $11.3 million (up 79%), led by South Africa but also with strong growth in Cote d’Ivoire, Gabon and Angola. These markets are among the top destinations for US beef livers, kidneys and hearts.

Mexico Fuels Rebound in June Lamb Exports

June exports of US lamb were the second largest of 2020 (following March) at 2,289 mt, up 113% from a year ago, while value climbed 29% to $2.23 million. First-half export volume was nearly even with last year at 7,752 mt, though value was down 21% to $10.43 million. Growth in June was led by a large increase in both muscle cut and variety meat shipments to Mexico, the leading destination for US lamb. Exports have also trended higher this year to Hong Kong and Kuwait.