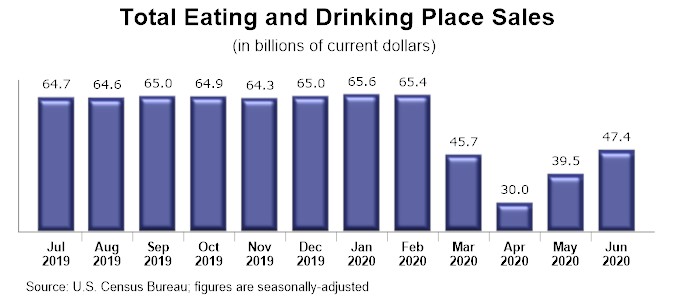

Restaurant sales in the United States rose for the second consecutive month in June, as local economies continued to reopen and state’s eased restrictions on commerce. While both consumers and operators welcomed the expanded dining opportunities, overall spending in restaurants remained well below normal levels. Looking forward, the road to recovery will be uneven, as some jurisdictions are backtracking amid spiking case levels.

Eating and drinking places registered sales of $47.4 billion last month on a seasonally adjusted basis, according to preliminary data from the US Census Bureau. That represented the second consecutive monthly sales gain, after falling to a low of $30 billion in April.

June represented the highest monthly sales volume since the beginning of the Covid-19 pandemic lockdowns in March, but still remained roughly $18 billion down from the pre-coronavirus sales levels posted in January and February.

While the seasonally adjusted figures offer a directional look at spending trends from month to month, they don’t provide a complete picture of the sales losses that have been experienced by restaurants during the pandemic. For this, the Census Bureau’s unadjusted data set is a better measure, because it represents the actual dollars coming in the door.

In total between March and June, eating and drinking place sales levels were down more than $116 billion from expected levels, based on the unadjusted data. Add in the sharp reduction in spending at non-restaurant foodservice operations in the lodging, arts/entertainment/recreation, education, healthcare and retail sectors, and the total shortfall in restaurant and foodservice sales likely surpassed $145 billion during the last four months.

Protein Shortages No Longer an Issue

Meanwhile, on a positive note, supply chain issues faced by the food industry at the outset of the coronavirus outbreak are no longer problematic, as production is believed to now be nearly back to normal.

Julie Anna Potts of the North American Meat Institute; Mark Smith of Centralized Supply Chain Services, LLC; and Kaffee Hopkins of Atlanta-based Marlow’s Tavern restaurants, addressed the issue during a recent National Restaurant Association webinar. Each shared insight on how Covid-19 has challenged restaurants, suppliers and distributors, and the solutions they’ve deployed to continue serving customers.

From March to May, several meat processing plants in the United States temporarily closed as employees tested positive for the coronavirus. This affected production and disrupted the supply chain. At the same time, retail demand for product increased as consumers, acting out of fear, started purchasing and hoarding items such as ground beef, choice steak, chicken breasts and pork chops.

NAMI’s Potts said the virus threatened to devastate the meat-processing industry for the following reasons:

- Employees’ fear drove high absenteeism at the processing plants despite worker support and protections. This forced facilities to slow production.

- Some plants closed for two days, others two weeks to try to stop the spread of the virus; other plants were unaffected.

- An Executive Order from President Donald J. Trump brought together local health authorities, the processors, the US Department of Agriculture and the Centers for Disease Control and Prevention to work on reopening the plants once worker protections were verified.

Since then, “… Many great conversations have taken place, and we have a much better fix on how to work together better and to deal with it more easily, especially if there’s another spike,” Potts said.

Still, finding innovative ways to set up staff in close conditions remains an important conversation because it’s something the industry will potentially have to prepare for again, she added.

The Present Situation

NAMI is optimistic about the quantity of available protein. Potts said production is almost back to normal, and that sow and hog processing in the United States is at nearly 100% sooner than people anticipated. On the poultry side, processing is ahead of where it was in 2019, and the amount of beef and pork in cold storage are at adequate levels to meet expected demand.

Smith, whose buying cooperative services all Applebee’s and IHOP operators in the United States, said that his company initially dealt with a series of challenges related to the supply slowdown, especially what to do with perishable items. But today, the meat supply is up and prices should remain level through summer and even into the third and fourth quarter, though it’s still too early to accurately predict what will happen.

Looking Ahead

Potts said there are three big questions that the meat-processing industry must answer.

- How can it communicate better with the entire supply chain to ensure disruptions are minimal?

- As supply shifts back to restaurants from grocery outlets, what are the flexibilities restaurants will need and be willing to accept?

- What other resources are available in dealing with supply chain challenges?

At the height of the pandemic, Marlow’s Tavern took a slightly different approach to the challenges by focusing on meal kit delivery. Hopkins described how the chain made a concerted effort to ensure that customers knew there were several proteins to choose from in those boxes – chicken, beef and seafood – rather than relying on one specific protein. This flexibility ensured that the chain never really experienced any shortages.

From the supply-chain perspective, Smith said he can’t recall ever seeing another situation as extreme as the one this pandemic created. “We know this is new territory. This is not about waiting for or relying on the same answers, information or systems that we used to rely on. This is change management at its most basic. It’s required a lot of coaching and hand-holding for us to navigate this together.”